Decoding the Market's Whisper: A Deep Dive into 30-Day Stock Charts

The stock market. A relentless pulse of data, a digital ocean of buy and sell orders, churning fortunes and anxieties with every tick. But how do you make sense of this constant flow of information? One powerful tool lies in examining the recent past, specifically, the stock market's performance over the last 30 days. This snapshot in time, visualized through a 30-day stock chart, can offer valuable insights into current market sentiment and potential future movements.

Imagine a heartbeat monitor, constantly tracking the vital signs of a living organism. A 30-day stock chart functions similarly, providing a concise visual representation of the market's recent activity. It's a window into the ebb and flow of investor confidence, revealing the push and pull between bullish optimism and bearish apprehension.

Why focus on the last 30 days? This timeframe strikes a balance between capturing short-term fluctuations and filtering out the noise of daily volatility. It allows investors to discern emerging trends, identify potential breakouts or breakdowns, and gauge the overall market momentum.

This detailed exploration of 30-day stock charts will equip you with the knowledge to interpret these crucial visual aids. We'll delve into their history, explore their significance in modern finance, and uncover the actionable insights they can provide. From understanding basic chart patterns to recognizing potential pitfalls, we'll navigate the complexities of short-term market analysis.

Understanding the market's recent trajectory is crucial for both seasoned traders and newcomers. By examining a one-month stock market graph, we gain a clearer picture of prevailing trends. This data visualization allows us to see the magnitude of price fluctuations and identify potential support and resistance levels.

The practice of charting stock market performance over short periods, including 30 days, has evolved alongside the markets themselves. Early stock traders relied on basic price records, but with the advent of computing, visualizing this data became much easier. Today, sophisticated software and online platforms offer dynamic and interactive charting tools, providing investors with a real-time view of market activity. This readily available information empowers individual investors with the same analytical capabilities once reserved for institutional players.

One of the primary benefits of analyzing a 30-day stock price chart is the ability to identify short-term trends. This allows for more agile trading strategies, capitalizing on momentum and mitigating potential losses by quickly reacting to shifts in market sentiment. For example, a consistent upward trend over the last month could suggest bullish momentum, while a series of lower lows might signal a bearish trend.

Another advantage is the ability to assess volatility. By observing the range of price fluctuations within the 30-day period, investors can gauge the risk associated with a particular stock or the market as a whole. A stock with wide price swings suggests higher volatility and potentially higher risk, while a stock with a narrow trading range indicates lower volatility and potentially lower returns.

Furthermore, studying a month-long stock market chart helps in recognizing potential support and resistance levels. Support levels represent price points where buying pressure is likely to outweigh selling pressure, preventing further price declines. Resistance levels, conversely, are price points where selling pressure is likely to overcome buying pressure, preventing further price advances.

A simple action plan for using 30-day charts is to first select the stocks or indices you wish to track. Then, choose a reliable charting platform and customize it to display the relevant indicators. Regularly monitor the charts, noting any emerging trends or patterns. Combine your chart analysis with other research methods, such as fundamental analysis and news sentiment, to gain a more comprehensive understanding of the market.

Advantages and Disadvantages of Using 30-Day Stock Charts

| Advantages | Disadvantages |

|---|---|

| Identifies short-term trends | May not capture long-term market cycles |

| Assesses volatility | Susceptible to short-term noise and fluctuations |

| Recognizes support/resistance | Requires regular monitoring and updates |

Interpreting short-term market trends through 30-day charts is a crucial skill for any investor. By understanding the recent price action, identifying potential opportunities, and recognizing warning signs, investors can make more informed decisions and navigate the complexities of the stock market with greater confidence.

This analysis provides a glimpse into the power of 30-day stock charts. By incorporating this tool into your investment strategy, you can gain a deeper understanding of market dynamics and improve your chances of success in the ever-evolving world of finance. Remember, the market's past doesn't guarantee future performance, but it offers invaluable clues to navigate the present and anticipate what lies ahead.

Picture of san miguel beer bottle a refreshing look at an iconic brand

Ride the wave your guide to wake surf rentals near you

Linkedin logo copy and paste what you need to know

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-02-85609403fbee41089d13a9ffa649bdac.jpg)

stock market last 30 days chart | Innovate Stamford Now

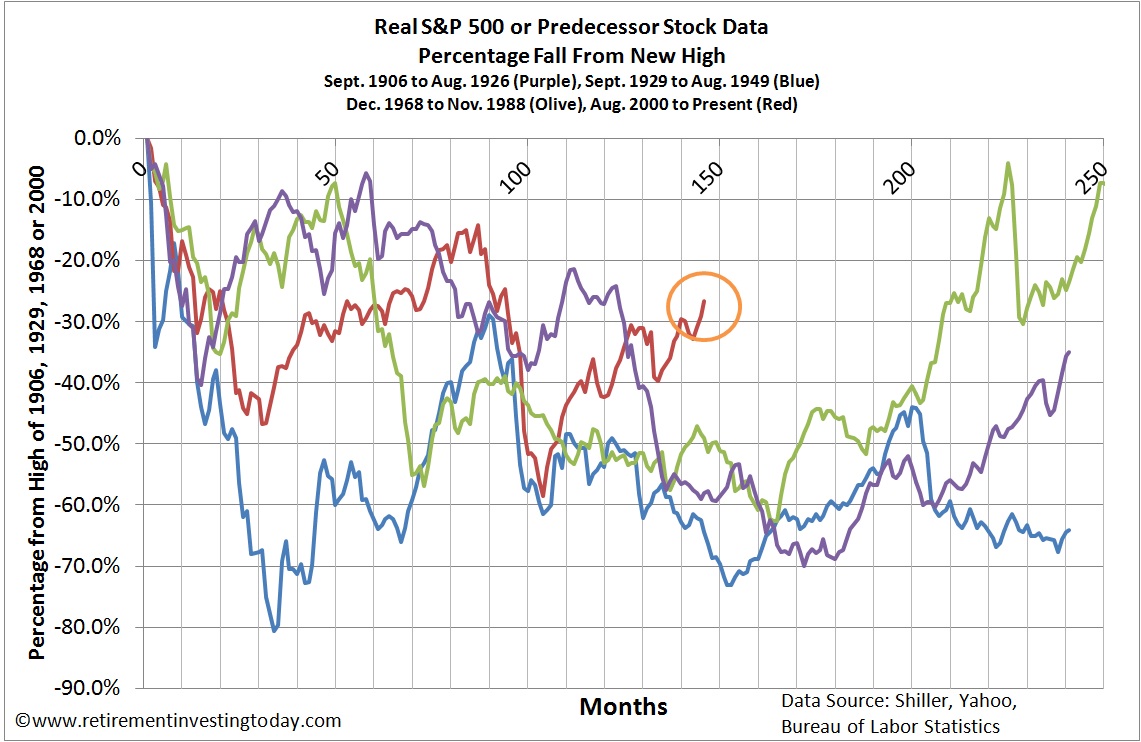

Stock market last 30 years chart | Innovate Stamford Now

Historical trends in the stock market black scholes option pricing | Innovate Stamford Now

Last Day Of Stock Market 2024 | Innovate Stamford Now

stock market last 30 days chart | Innovate Stamford Now

Dow Jones Daily High And Low at Louis Skinner blog | Innovate Stamford Now

What Investors Missed in the Stock Market Last Week | Innovate Stamford Now

stock market last 30 days chart | Innovate Stamford Now

Stock Market Performance by President in Charts | Innovate Stamford Now

stock market last 30 days | Innovate Stamford Now

Stock Market Value Last 20 Years at Amparo Thomas blog | Innovate Stamford Now

Google Stocks History at Lisa Tucker blog | Innovate Stamford Now

Patagonia Fitz Roy Horizons | Innovate Stamford Now

Stock Market Last 30 Days May 2020 | Innovate Stamford Now

Concentrated Performance in the Stock Market | Innovate Stamford Now