Decoding Your Paycheck: Understanding Cara Kiraan Gaji Malaysia

Have you ever received your paycheck and wondered how the final figure came to be? Or perhaps you're starting a new job in Malaysia and want to understand the ins and outs of the salary system. It's easy to feel overwhelmed, but deciphering your salary doesn't have to be a mystery. We're about to break down the basics of "cara kiraan gaji Malaysia" – essentially, how salaries are calculated in Malaysia.

Imagine this: you've landed your dream job, the interview was a breeze, and you're feeling confident. Then comes the offer letter, filled with terms like "EPF," "SOCSO," and "PCB." Suddenly, that confidence might take a bit of a dip. Don't worry, we've all been there. Understanding these terms and the overall salary calculation process is crucial for anyone working or planning to work in Malaysia. It empowers you to manage your finances better and ensure you're being compensated fairly.

In Malaysia, the way your salary is calculated goes beyond your basic pay. Several factors come into play, including allowances, deductions, and statutory contributions. Knowing what these are and how they affect your take-home pay can make a big difference in your financial planning.

Think of it like putting together a puzzle. Your basic salary is just one piece. You need to add in other pieces like allowances for housing, transportation, or overtime to get a clearer picture. But then, there are deductions for taxes, social security, and employee contributions. Understanding how these pieces fit together gives you the complete picture of your "cara kiraan gaji" or salary calculation.

Whether you're a fresh graduate about to embark on your career journey or simply looking to demystify your pay slip, understanding the Malaysian salary system is essential. It's about more than just knowing how much money you're getting; it's about taking control of your financial well-being and making informed decisions. So let's delve into the world of "cara kiraan gaji Malaysia" and equip you with the knowledge to navigate your finances with confidence.

Advantages and Disadvantages of Understanding Cara Kiraan Gaji Malaysia

| Advantages | Disadvantages |

|---|---|

| Empowers you to negotiate salary better | Can be time-consuming to understand initially |

| Helps in budgeting and financial planning | May lead to disappointment if actual salary is lower than expected |

| Ensures you are being paid fairly and legally | Requires staying updated on any changes in tax laws or regulations |

Five Best Practices for Managing Your Finances in Malaysia

1. Track Your Spending: Utilize budgeting apps or a simple spreadsheet to understand where your money is going each month.

2. Set Financial Goals: Whether it's saving for a down payment, a dream vacation, or early retirement, having clear goals helps you stay motivated and focused.

3. Build an Emergency Fund: Aim for at least three to six months' worth of living expenses in a readily accessible account to cover unexpected events.

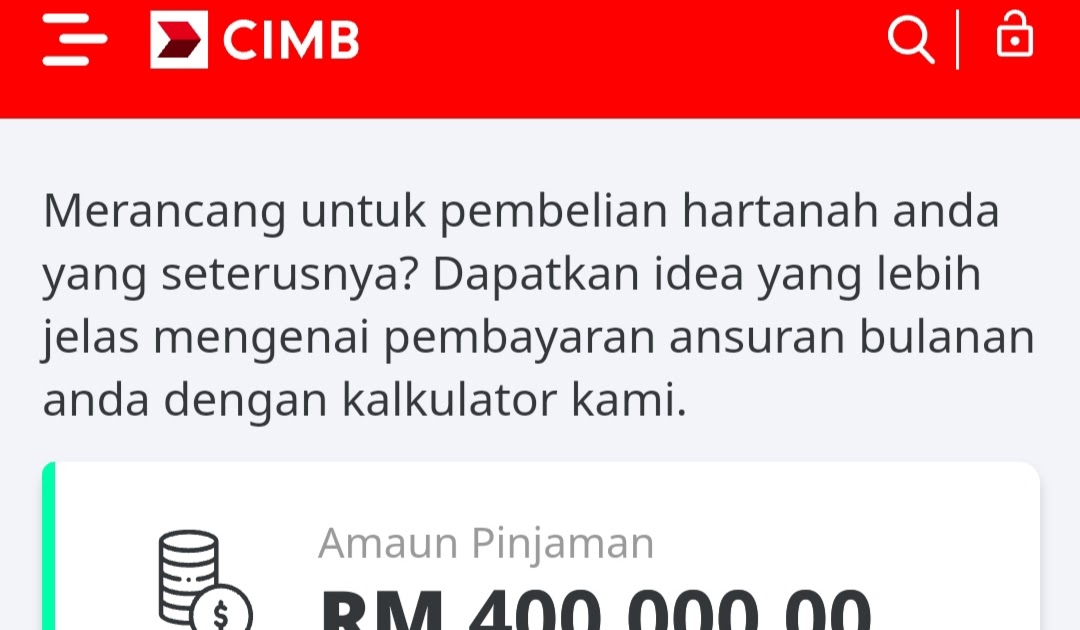

4. Explore Investment Opportunities: Consider low-risk options like fixed deposits or explore other investment avenues to grow your wealth over time.

5. Review and Adjust Regularly: Your financial situation can change, so it's crucial to review your budget, goals, and investment strategies periodically and make adjustments as needed.

Eight Common Questions About Cara Kiraan Gaji Malaysia (and Answers!)

1. What is EPF and SOCSO? EPF (Employees Provident Fund) is a retirement savings scheme, while SOCSO (Social Security Organisation) provides social security protection in events like accidents or illnesses.

2. How is income tax calculated in Malaysia? Malaysia follows a progressive tax system, meaning higher earners pay a larger percentage of their income in taxes.

3. What are allowances, and how do they affect my salary? Allowances are payments made to employees for specific purposes, such as housing, transportation, or work-related expenses. They can be fixed or variable and can increase your gross salary.

4. What are the common salary deductions in Malaysia? Besides taxes and statutory contributions (EPF, SOCSO), other potential deductions include loan repayments, insurance premiums, or union fees.

5. How do I calculate my net salary? Your net salary, or take-home pay, is calculated by subtracting all deductions from your gross salary.

6. Are overtime payments calculated differently? Yes, overtime is typically calculated at a higher rate than your regular hourly wage.

7. What if my salary is not calculated correctly? You have the right to address any discrepancies with your employer. If issues persist, you can seek guidance from the Labour Department.

8. Where can I find more information about salary calculations in Malaysia? The Inland Revenue Board of Malaysia (LHDN) and the Labour Department provide comprehensive resources on taxes and employment regulations, including salary-related matters.

Tips and Tricks for Navigating Your Salary in Malaysia

Negotiate Your Salary: Don't be afraid to negotiate your starting salary or ask for a raise when you feel you deserve it. Do your research and come prepared with industry benchmarks and your accomplishments.

Understand Your Benefits: Your compensation package might include more than just your salary. Explore other benefits offered, such as health insurance, retirement plans, or professional development opportunities.

Stay Updated: Tax laws and regulations can change, so stay informed about any updates that might affect your salary calculation. Subscribe to relevant newsletters or check official government websites.

Seek Professional Advice: If you have complex financial questions or need personalized guidance, don't hesitate to consult with a financial advisor who can provide tailored advice based on your specific situation.

Understanding the intricacies of "cara kiraan gaji Malaysia" might seem daunting at first. Still, by taking the time to grasp the basics, you're already one step ahead in managing your finances effectively. Remember, knowledge is power, especially when it comes to your hard-earned money. By being proactive and informed, you can make confident financial decisions, maximize your earnings, and plan for a secure future.

Anime boy profile pictures a deep dive into the digital persona

Decoding the chin beard whats that patch of awesome called

Elevating your bathroom a complete guide to rustic vessel sink vanities

Cara Pengiraan Gaji Pekerja | Innovate Stamford Now

Gaji Grab Food Rider di Malaysia | Innovate Stamford Now

cara kiraan gaji malaysia | Innovate Stamford Now

Senarai Cuti Am Yang Wajib Diambil Majikan & Cara Kira Overtime | Innovate Stamford Now

Waktu Bekerja & Cara Kira Gaji Lebih Masa | Innovate Stamford Now

Cara Kiraan Gaji Harian (Malaysia) | Innovate Stamford Now

cara kiraan gaji malaysia | Innovate Stamford Now

Cara Pengiraan Pencen / Faedah Persaraan Penjawat Awam | Innovate Stamford Now

Template Slip Gaji Malaysia | Innovate Stamford Now

Usb 2 Ethernet Adapter Driver | Innovate Stamford Now

Contoh Cara Kiraan Pinjaman Perumahan Gaji Bawah RM3,000 | Innovate Stamford Now

Kaedah Kiraan, Cara Bayar Zakat Simpanan di Malaysia 2024 | Innovate Stamford Now

Format Penyata Gaji Contoh Slip Gaji Malaysia | Innovate Stamford Now

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | Innovate Stamford Now

Cara Pengiraan Gaji Pekerja Bagaimana Kiraan Ot Kalau Pekerja Baru | Innovate Stamford Now