Ditch Your Bank Online A Guide to Closing Your Account

Ever felt the itch to declutter your financial life? Closing an unused or unwanted bank account is a great place to start. This guide will walk you through the surprisingly simple process of canceling a bank account online, empowering you to take control of your finances.

Closing a bank account used to involve a trip to the bank and a lengthy process. Today, many banks offer the convenience of online account closure, saving you time and hassle. But navigating this digital landscape can be confusing. This article aims to demystify the process and answer all your questions about terminating your bank account via the internet.

The rise of online banking has revolutionized how we manage our finances. From checking balances to transferring funds, almost every banking task can be completed online. Closing an account is no exception. The ability to close a bank account online reflects the broader shift towards digital convenience in the financial world. It empowers customers with greater control and flexibility in managing their banking relationships.

One of the most significant issues with closing a bank account online, and offline for that matter, is ensuring you've resolved any outstanding transactions or automatic payments linked to the account. Failure to do so can lead to returned payments, fees, and even damage to your credit score. Understanding this crucial step is essential for a smooth account closure.

Terminating a bank account online simply means using your bank's website or mobile app to formally request the closure of your account. It's a digital alternative to visiting a physical branch. For example, if you have an account with Bank X and they offer online account closure, you can log into your online banking portal and navigate to the account settings to initiate the closure process.

Benefits of closing a bank account online include saving time, avoiding travel to a physical branch, and often enjoying 24/7 access to the closure process. This convenience allows you to manage your finances on your own schedule.

Before initiating an online closure, ensure you have zeroed out your balance, transferred any recurring deposits to another account, and canceled all automatic payments linked to the account. Check with your bank for specific instructions on their online closure process.

Successful online account closures often involve prompt communication from the bank confirming the closure. You might receive an email or a notification within your online banking portal acknowledging the closure request.

Checklist for Closing a Bank Account Online:

1. Zero out the account balance.

2. Set up a new account (if needed).

3. Redirect automatic payments and deposits.

4. Contact your bank to confirm online closure availability.

5. Follow the bank's online closure instructions.

Advantages and Disadvantages of Closing a Bank Account Online

| Advantages | Disadvantages |

|---|---|

| Convenience and time-saving | Potential for technical issues |

| 24/7 accessibility | May require additional steps for complex accounts |

| No need to visit a branch | Less personal interaction for those who prefer it |

Best Practices:

1. Review your bank's specific instructions. Each bank has its own procedures.

2. Ensure a zero balance. Avoid returned payments and fees.

3. Redirect automatic transactions. Update bill payments and deposits to your new account.

4. Download your transaction history. Keep records for your files.

5. Confirm closure with your bank. Ensure a successful termination.

FAQs:

1. Can I reactivate a closed account? This depends on the bank's policy.

2. What happens to pending transactions? Ensure all transactions are processed before closing.

3. Will I receive confirmation? Most banks provide confirmation of closure.

4. How long does the process take? It varies, but usually within a few business days.

5. Are there any fees? Generally, there are no fees for closing an account.

6. What if I have automatic payments linked to the account? Cancel or redirect them before closing.

7. Can I close a joint account online? This depends on the bank and the type of joint account.

8. What if I lose access to online banking? Contact your bank's customer service.

Tips and Tricks: Double-check everything before submitting your closure request. Having a new account set up beforehand simplifies the transition.

Closing a bank account online offers unparalleled convenience and control over your financial life. By following the steps and best practices outlined in this guide, you can seamlessly terminate an unwanted account. Taking control of your financial life involves active management of your accounts. Closing unused or unnecessary accounts not only simplifies your banking but also reduces the risk of potential fees and complications. Start decluttering your finances today by taking advantage of the quick and easy process of online account closure. Empowered with the knowledge of how to terminate your bank account digitally, you can streamline your financial life and focus on your financial goals. Don’t wait, take charge of your financial well-being and close that unwanted account today.

Captivating anime drawings of handsome men a comprehensive guide

Mahindra air filter cross reference breathe easy with the right filter

Unlocking interior harmony with behr paint colors

how to cancel a bank account online | Innovate Stamford Now

how to cancel a bank account online | Innovate Stamford Now

Bank Account Closing Letter Printable Template in PDF Word Pack of 3 | Innovate Stamford Now

how to cancel a bank account online | Innovate Stamford Now

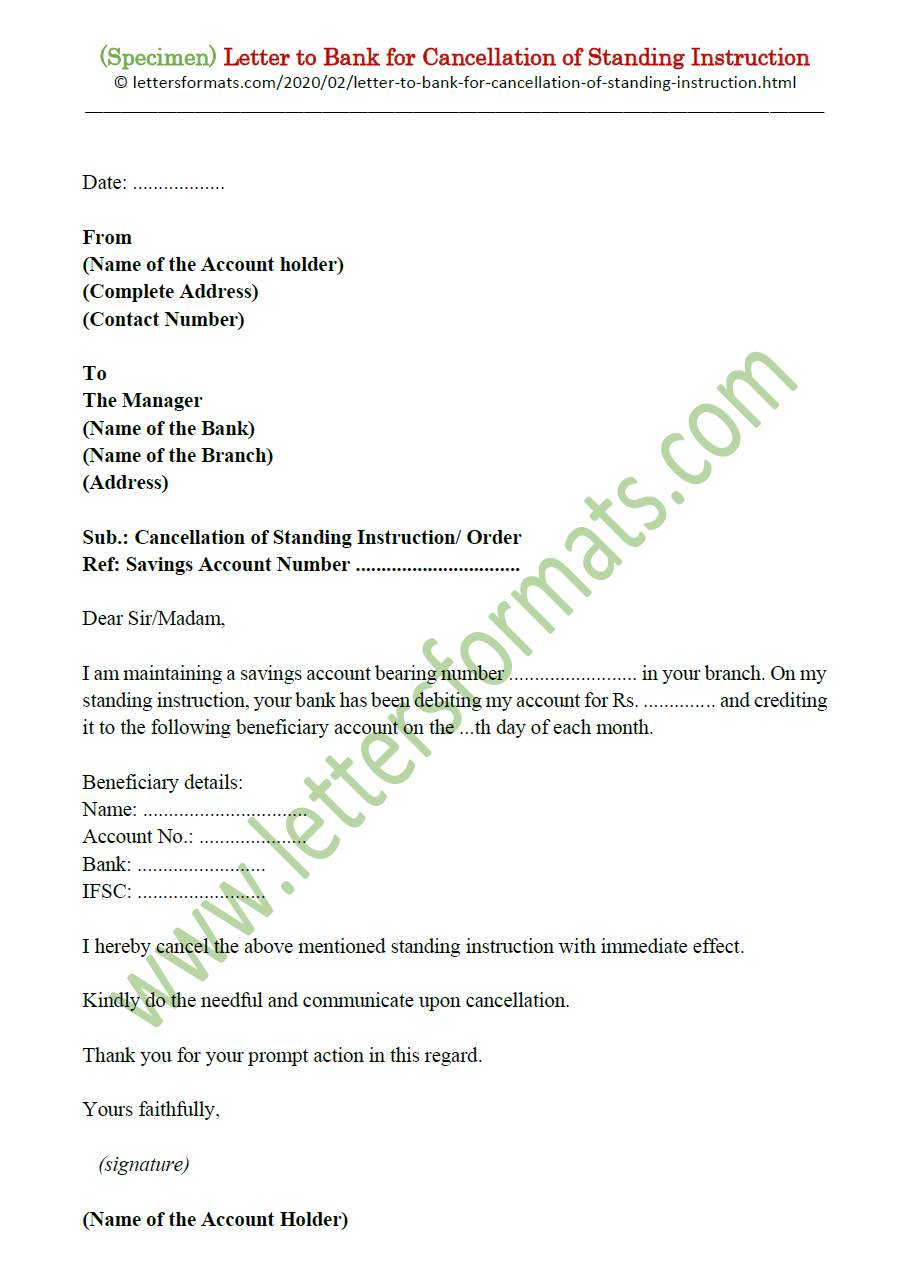

Letter to Bank for Cancellation of Standing Instruction Order | Innovate Stamford Now

Creating a bank account | Innovate Stamford Now

How To Write A Letter Asking For More Money In A Job Offer | Innovate Stamford Now

Request Letter to Bank for Cancellation Closing of Credit Card | Innovate Stamford Now

How do I stop direct debits Leia aqui Can you cancel a Direct Debit | Innovate Stamford Now

Cancelled Cheque How to Write One and Why It Matters | Innovate Stamford Now

Letter Of Cancellation Template | Innovate Stamford Now

How to make SBI Cancelled Cheque | Innovate Stamford Now

Branch Manager Letter Format Change Of Address Letter To Bank | Innovate Stamford Now

How to avoid misuse of cancelled cheques | Innovate Stamford Now

Why Cant I Lock My Credit Card at Malcolm Broussard blog | Innovate Stamford Now