Does Wells Fargo Accept Signed Over Checks? What You Need to Know

Have you ever received a check that wasn't made out directly to you, with someone signing it over in your name? It might seem like a convenient way to transfer funds, but it raises a common question: Do banks readily accept these signed-over checks?

The practice of signing a check over to someone else is called a "third-party endorsement." While it seems straightforward, many financial institutions have policies that make accepting these checks tricky. This is due, in part, to increased instances of fraud and the potential for complications.

So, does Wells Fargo accept signed over checks? The short answer is: It's complicated. While Wells Fargo may accept some third-party checks, they generally discourage this practice and have specific requirements that need to be met.

Understanding Wells Fargo's policies on third-party checks is important to avoid potential issues with deposits. This article will delve into the specifics of these policies and what you need to know.

Let's break down the details about third-party checks at Wells Fargo, exploring the potential challenges and providing you with the information you need for smooth transactions.

Advantages and Disadvantages of Third-Party Checks

Using third-party checks comes with its own set of advantages and disadvantages. Let's examine both sides:

| Advantages | Disadvantages |

|---|---|

| Convenience in transferring funds to another person. | Increased risk of fraud and potential for disputes. |

| Can be useful in situations where direct payment isn't possible. | Many banks, including Wells Fargo, have restrictions on third-party checks. |

Best Practices When Dealing with Third-Party Checks at Wells Fargo

If you find yourself needing to deal with a third-party check at Wells Fargo, keep these best practices in mind:

- Contact Wells Fargo Directly: Before you head to the bank, call your local branch or the Wells Fargo customer service line. Explain your situation and inquire about their specific policies and requirements for third-party checks.

- Verify Identification: Wells Fargo, like other banks, prioritizes security. Ensure you bring proper identification, such as a driver's license or passport, when depositing a third-party check.

- Be Prepared for Additional Documentation: The bank may ask for additional documentation, such as a signed statement from the original payee or proof of the reason for the third-party endorsement.

- Consider Alternative Options: If possible, explore alternative methods of payment that are more readily accepted and less prone to complications. This could include mobile payment apps, direct deposits, or cashier's checks.

- Be Patient: Processing third-party checks may take longer than standard check deposits. Be prepared for potential delays and follow up with the bank if necessary.

Common Questions About Third-Party Checks at Wells Fargo

Here are some frequently asked questions about Wells Fargo's policies on third-party checks:

- Q: Can I deposit a check made out to someone else into my Wells Fargo account?

A: It's possible, but Wells Fargo has specific requirements for third-party checks, and they might not always be accepted. Contact your branch for details. - Q: What are the risks of accepting a third-party check?

A: The primary risks include fraud, as the check's legitimacy can be difficult to verify. There's also the possibility of the check bouncing or facing delays in processing. - Q: What if the original payee's name is misspelled on the check?

A: Minor misspellings might be overlooked, but it's best to ask the original payee to correct the error and initial the change. Contact Wells Fargo for specific guidance. - Q: Can I cash a third-party check at Wells Fargo?

A: Cashing third-party checks is generally riskier for banks, and Wells Fargo may have stricter policies regarding this. It's best to contact them directly to inquire about cashing such checks. - Q: Does Wells Fargo charge a fee for depositing third-party checks?

A: While Wells Fargo doesn't typically charge for standard check deposits, fees for third-party checks might vary. It's advisable to confirm this with your branch or check their fee schedule. - Q: What happens if a third-party check I deposit is returned?

A: If the check bounces, you will likely be responsible for the amount, along with potential fees. Contact Wells Fargo immediately to understand the process and your options.

Navigating the world of third-party checks, especially at a large financial institution like Wells Fargo, requires awareness and caution. Understanding the bank's policies and following recommended practices can help minimize risks and streamline your transactions. When in doubt, always reach out to your bank directly for clarification.

Unlocking poetic potential mastering poetry writing rubrics

Unveiling the mystery what you need to know about po box 5105 sioux falls sd

The art of the facebook profile picture choosing the perfect imagen

does wells fargo accept signed over checks | Innovate Stamford Now

Wells Fargo Mobile Deposit | Innovate Stamford Now

Does Wells Fargo Accept Coins? An In | Innovate Stamford Now

Does Wells Fargo Accept Third Party Checks? | Innovate Stamford Now

What is a Luxury Suite at the Wells Fargo Center? | Innovate Stamford Now

does wells fargo accept signed over checks | Innovate Stamford Now

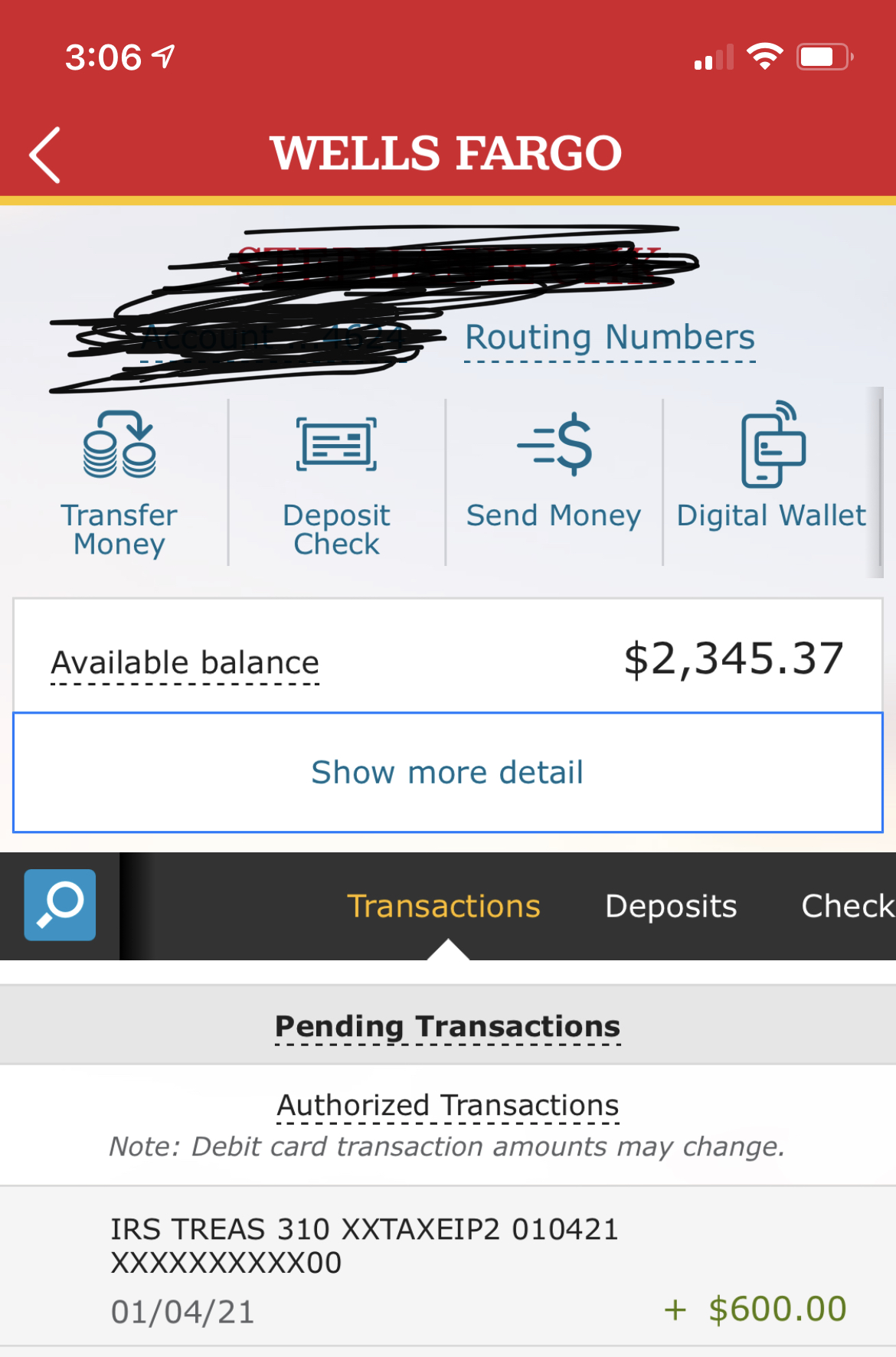

Wells Fargo Stimulus Check | Innovate Stamford Now

does wells fargo accept signed over checks | Innovate Stamford Now

Does Wells Fargo cash checks? | Innovate Stamford Now

Rolled Coins Wells Fargo? Quick Answer | Innovate Stamford Now

does wells fargo accept signed over checks | Innovate Stamford Now

As of October 2020, NYS will only accept a REAL ID or an Enhanced | Innovate Stamford Now

Does Wells Fargo Accept Third Party Checks? Exploring the Pros and Cons | Innovate Stamford Now

Does Wells Fargo Accept Bitcoin? Understanding the Bank's Stance on | Innovate Stamford Now

does wells fargo accept signed over checks | Innovate Stamford Now