Gifting Shares: A Comprehensive Guide to Gift Deeds for Share Transfers

Imagine wanting to share a piece of your successful business venture with a loved one. You've poured your heart and soul into building this company, and now, you want to give back. Instead of handing over cash, you consider something more meaningful: gifting shares of your company. This is where the concept of a "gift deed for transfer of shares" comes into play.

A gift deed for the transfer of shares, at its core, is a legal document that allows you to transfer ownership of shares in a company to another person as a gift. It's a way to bestow a financial asset with the potential for growth and dividends, all without any monetary exchange. Think of it as passing on a piece of your legacy.

But navigating the world of share transfers isn't as simple as handing someone a stock certificate. A gift deed formalizes the process, ensuring everything is legally sound and binding. This document outlines the details of the transfer, including the identities of the parties involved, the number of shares being gifted, and any specific conditions attached.

The importance of a gift deed cannot be overstated. It serves as concrete evidence of the transfer, preventing future disputes and misunderstandings. Without this document, the recipient might encounter obstacles when trying to exercise their rights as a shareholder, such as voting on company matters or receiving dividends.

Understanding the intricacies of a gift deed for the transfer of shares is essential whether you're a seasoned entrepreneur or someone looking to gift a portion of your holdings. In the following sections, we'll delve deeper into this process, exploring its benefits, steps involved, legal considerations, and potential challenges to ensure a smooth and successful share transfer.

Advantages and Disadvantages of Using a Gift Deed for Share Transfer

Before diving into the details, let's weigh the pros and cons of utilizing a gift deed for transferring shares:

| Advantages | Disadvantages |

|---|---|

| Simple and cost-effective method | Potential tax implications for the recipient |

| Facilitates estate planning | Possible gift tax liability for the donor |

| Enables sharing of company profits with loved ones | Loss of control over the gifted shares |

Best Practices for Implementing a Gift Deed for Share Transfer

To ensure a seamless and legally compliant share transfer, consider these best practices:

- Consult with legal counsel: Seek guidance from an attorney specializing in corporate law to draft and review the gift deed, ensuring it adheres to all legal requirements.

- Verify company regulations: Different companies might have specific procedures or restrictions related to share transfers. Familiarize yourself with these rules beforehand.

- Obtain company consent: Certain companies require prior consent before transferring shares. Check if this applies to your situation and obtain the necessary approvals.

- Execute the deed properly: Ensure the gift deed is signed by both parties, witnessed, and dated correctly to avoid any issues with its validity.

- File with relevant authorities: Notify the company and relevant authorities, such as the registrar of companies, about the share transfer.

Common Questions and Answers about Gift Deeds for Share Transfers

Here are some frequently asked questions to provide further clarity:

- Q: Can I revoke a gift deed after the transfer is complete?

A: Generally, gift deeds are irrevocable once executed, meaning they cannot be reversed easily. - Q: Are there any tax implications for the recipient?

A: Depending on the jurisdiction, the recipient might incur capital gains tax when they eventually sell the shares. - Q: What happens if the company is sold after the share transfer?

A: The recipient, as the new shareholder, would be entitled to their portion of the proceeds from the sale.

Conclusion

Gifting shares of your company can be a powerful way to share your success with loved ones, contribute to their financial well-being, and even facilitate estate planning. A gift deed for the transfer of shares serves as the legal bedrock for this process, ensuring a smooth and legally sound transition of ownership. While the concept might seem straightforward, navigating the nuances of share transfers, legal requirements, and potential tax implications requires careful consideration. By seeking guidance from legal professionals and following best practices, you can ensure a seamless and secure transfer, leaving a lasting legacy for your loved ones.

Transform your home with behr exterior paint and primer

Sherwin williams blue colors disrupting the paint industry

Unlocking epic fathers day the ultimate guide to cool dad presents

Transfer Of Shares Agreement Template Free | Innovate Stamford Now

Gift Deed Format, Clauses, Stamp Duty & How to Draft Gift Deed | Innovate Stamford Now

Stamp Duty & Share transfer: difference on | Innovate Stamford Now

Transfer of shares by way of GIFT | Innovate Stamford Now

Deed Of Gift Template | Innovate Stamford Now

Free Printable Gift Deed Form Texas | Innovate Stamford Now

Free Customizable Shares Transfer Agreement Template | Innovate Stamford Now

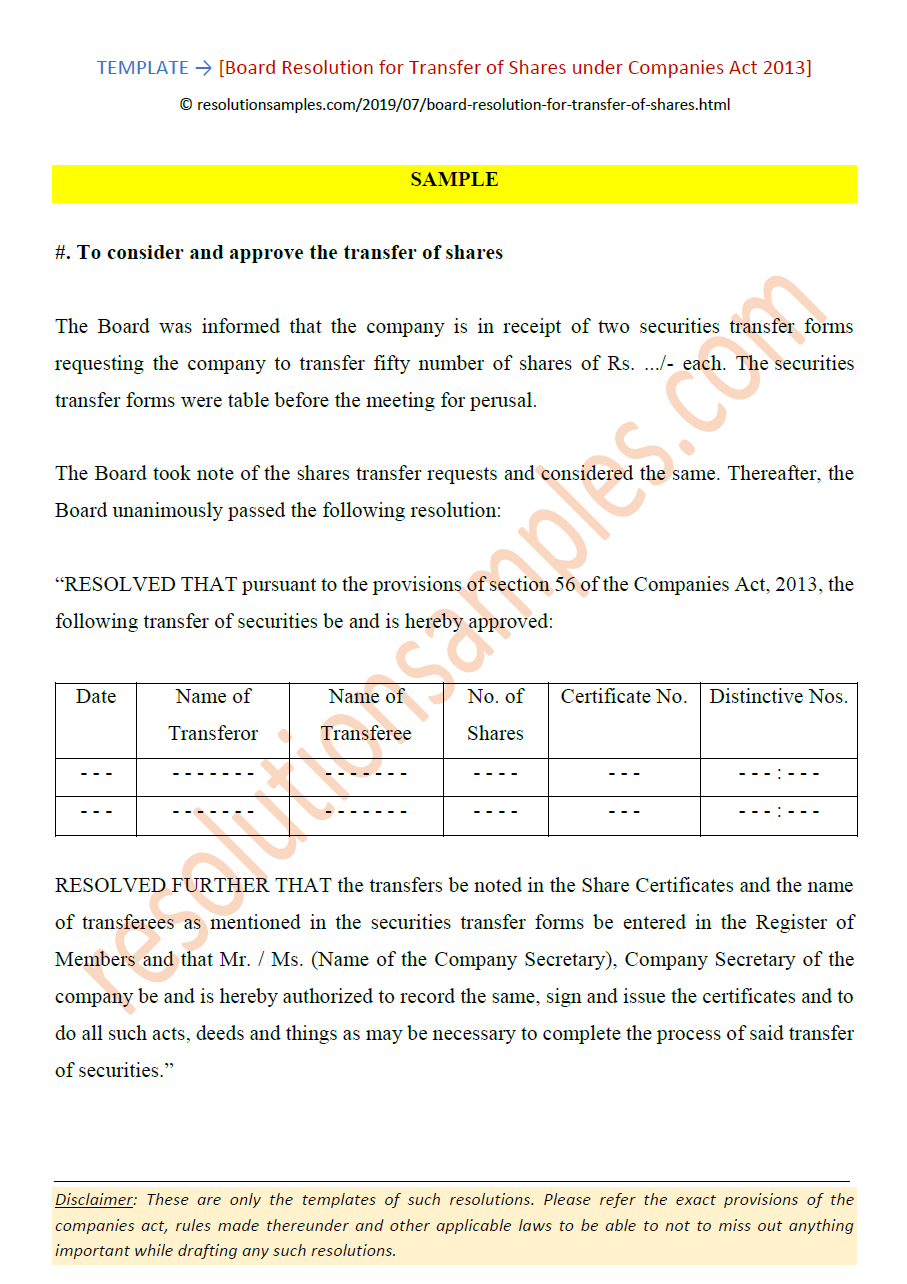

Sample Board Resolution for Approval for Transfer of Shares | Innovate Stamford Now

Template Deed of Assignment of Shares.docx | Innovate Stamford Now

Free Printable Gift Deed Form | Innovate Stamford Now

20+ Free Printable Deed of Gift Form Templates & Samples » Template | Innovate Stamford Now

Share Sale Agreement Template | Innovate Stamford Now

India Deed of Transfer for Flat | Innovate Stamford Now

Transfer Of Shares Agreement Template Free | Innovate Stamford Now

Gift Deed Template Free | Innovate Stamford Now