Mastering the Roles of Finance and Administration Managers

In today's dynamic business landscape, effective financial and administrative management is paramount to an organization's success. Steering the ship toward financial stability and operational efficiency falls largely on the shoulders of finance and administration managers – roles often intertwined and critical for sustainable growth. But what exactly do these individuals do, and how do their responsibilities (tugas pengurus kewangan dan pentadbiran) impact the bigger picture?

Imagine a company without a clear financial strategy, where budgets are haphazardly managed, and administrative tasks lack streamlined processes. Chaos would ensue, hindering growth and potentially leading to its downfall. This highlights the importance of finance and administration managers. They are the architects who design, implement, and oversee the financial and administrative frameworks that keep an organization running smoothly.

The roles of finance and administration managers are diverse and multifaceted. They are responsible for a wide range of tasks, including financial planning and analysis, budgeting, accounting, reporting, risk management, human resources, procurement, and general administrative support. Their decisions and actions directly impact an organization's profitability, efficiency, and long-term sustainability.

However, the significance of these roles extends beyond simply managing numbers and processes. Finance and administration managers are also strategic partners within their organizations, providing insights and recommendations to senior leadership for informed decision-making. They play a crucial role in ensuring compliance with financial regulations, mitigating risks, and optimizing resource allocation to achieve organizational goals.

In essence, finance and administration managers are the backbone of any successful organization. Their expertise in financial management and administrative processes provides a solid foundation for growth, stability, and operational excellence. By efficiently managing resources, ensuring compliance, and driving strategic initiatives, they empower organizations to navigate the complexities of the modern business world and achieve sustainable success.

Advantages and Disadvantages of Centralizing Finance and Admin Roles

Combining finance and administration functions under one manager can offer advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Streamlined communication and decision-making | Potential for work overload and burnout |

| Improved resource allocation and cost savings | Risk of reduced specialization and expertise in specific areas |

| Enhanced collaboration and synergy between departments | Possible conflicts of interest if not managed appropriately |

Best Practices for Finance and Admin Managers

Regardless of the specific organizational structure, certain best practices can guide finance and administration managers in excelling in their roles:

- Embrace Technology: Utilize financial and administrative software to automate tasks, improve accuracy, and gain valuable insights from data analysis.

- Prioritize Communication: Foster open and transparent communication with stakeholders across all levels to ensure everyone is aligned with financial and operational goals.

- Focus on Continuous Improvement: Regularly review and refine processes to identify areas for optimization, efficiency gains, and cost savings.

- Invest in Professional Development: Stay abreast of industry trends, regulations, and best practices through ongoing training and certifications.

- Build a Strong Team: Recruit, retain, and develop a skilled and motivated team capable of handling the diverse responsibilities within finance and administration.

The role of finance and administration managers is central to an organization's success. By effectively managing financial resources, streamlining administrative processes, and providing strategic guidance, these professionals ensure smooth operations, support growth initiatives, and contribute significantly to achieving overarching business objectives. As the business landscape continues to evolve, their ability to adapt, innovate, and embrace new technologies will be paramount in navigating challenges and seizing opportunities in the future.

Unveiling the maid a novel summary and exploration

Gr corolla that gas tank thoughseriously

Navigating information about individuals detained in craighead county jail

tugas pengurus kewangan dan pentadbiran | Innovate Stamford Now

Tugas Pengurus Kewangan, Kemahiran dan Kelayakan di Maukerja | Innovate Stamford Now

Spesifikasi Tugas Pengurus Pentadbiran Dan Kewangan | Innovate Stamford Now

tugas pengurus kewangan dan pentadbiran | Innovate Stamford Now

Kertas Kerja Perniagaan (LM 2025) | Innovate Stamford Now

Spesifikasi Tugas Pengurus Pentadbiran Dan Kewangan Tugas Pokok | Innovate Stamford Now

Spesifikasi Tugas Pengurus Pentadbiran Dan Kewangan | Innovate Stamford Now

Spesifikasi Tugas Pengurus Pentadbiran Dan Kewangan | Innovate Stamford Now

Spesifikasi Tugas Pengurus Pentadbiran Dan Kewangan | Innovate Stamford Now

KONSEP PENGURUSAN, PENTADBIRAN DAN PENGELOLAAN | Innovate Stamford Now

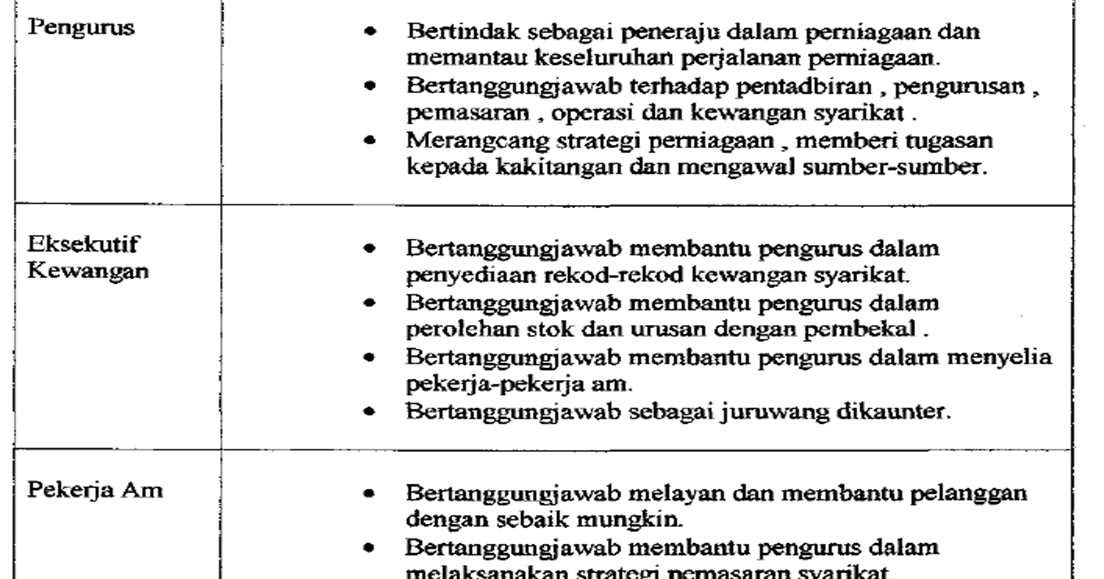

Tanggungjawab Dan Tugas Pekerja | Innovate Stamford Now

tugas pengurus kewangan dan pentadbiran | Innovate Stamford Now