Navigating Financial Waters: Bank of America Certified Check Image

In the whirlwind of today's fast-paced world, where transactions happen at lightning speed, ensuring the security and legitimacy of your finances is paramount. We often find ourselves relying on traditional banking methods, especially for significant transactions like purchasing a car or putting a down payment on a dream home. In these moments, a sense of trust and assurance is invaluable. That's where the concept of a certified check comes in, a beacon of security in the sometimes-turbulent seas of finance.

Imagine this: you've found the perfect vintage armchair, a statement piece to complete your living room. The seller, however, only accepts certified checks. You step into your local Bank of America branch, a familiar haven in your bustling city. As you request a certified check, a sense of calm washes over you. You know that this piece of paper, bearing the official stamp of the bank, represents a guarantee, a promise that funds are secure and the transaction will proceed smoothly.

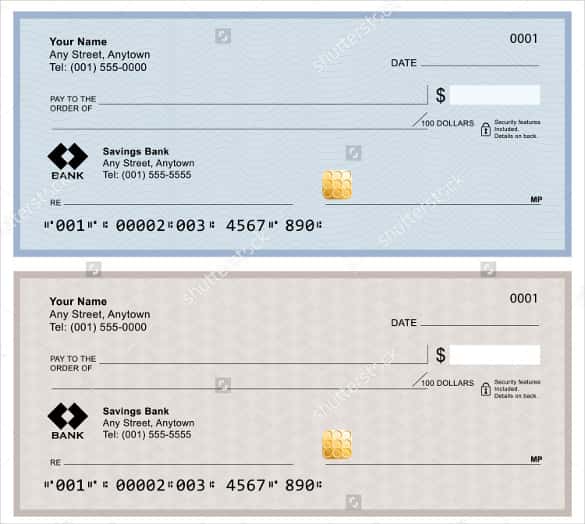

But what exactly is a Bank of America certified check image, and why is it important? A certified check is more than just a piece of paper; it's a financial instrument that offers a heightened level of security. When you request a certified check, Bank of America verifies the funds in your account and sets them aside specifically for that check. This means the recipient can be certain that the funds are available and the check won't bounce.

The beauty of the certified check lies in its tangible nature. Unlike digital transactions, which can sometimes feel abstract and distant, a certified check is something you can hold in your hand, a physical representation of your commitment. This tangibility creates a sense of trust and transparency, particularly valuable in transactions where large sums of money are involved.

In a world increasingly reliant on digital transactions, the certified check stands as a symbol of stability and reliability. It's a reminder that even in our fast-paced digital age, some things are best handled with a touch of tradition and a guarantee of security. Whether you're a seasoned investor or simply navigating a significant personal purchase, understanding the role of a certified check can empower you to make informed and secure financial decisions.

Advantages and Disadvantages of Bank of America Certified Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed funds | Less convenient than digital payments |

| Increased security | Potential for loss or theft |

| Widely accepted for large transactions | May involve fees |

While we don't encourage sharing sensitive financial information like images of certified checks online, understanding their importance and how they function can be incredibly empowering in navigating the financial landscape with confidence.

Decoding samsung refrigerator noises

Fifa 24 on microsoft store pc your ultimate guide

Heartfelt farewells finding the words when a friend embarks on a journey frases para una amiga que se va de viaje

Bank Of America Printable Checks | Innovate Stamford Now

Free Check Printing Template | Innovate Stamford Now

How To Cash A Cashier's Check At Bank Of America | Innovate Stamford Now

Bank Of America Cashier's Check Template | Innovate Stamford Now

:max_bytes(150000):strip_icc()/what-difference-between-cashiers-check-and-money-order-FINAL-9a54f3bddd144fd8af92fbe3aed9512b.png)

Can you pay with a credit card to get a money order? Leia aqui: Can you | Innovate Stamford Now

Bank Of America Dept Az9 | Innovate Stamford Now

Pin by Evan Michael on Quick Saves | Innovate Stamford Now

bank of america certified check image | Innovate Stamford Now

Check Fraud Quotes. QuotesGram | Innovate Stamford Now

1937 Farmers Bank Of Carson Valley | Innovate Stamford Now

What is a Certified Check & How Do You Get One? | Innovate Stamford Now

Pin by Ahmed Zaki on Quick Saves in 2022 | Innovate Stamford Now

bank of america certified check image | Innovate Stamford Now

Can You Get One Check From The Bank at Joe Carr blog | Innovate Stamford Now

Cashier Check Template Free | Innovate Stamford Now