Securing Your Future: Understanding Pengiraan Pencen JPA Bersara Pilihan

Retirement marks a significant life transition, a time to reap the rewards of years of hard work and dedication. For Malaysian civil servants, understanding the intricacies of the pension system, particularly "pengiraan pencen jpa bersara pilihan," is crucial for securing a comfortable and financially stable future. This article delves into the concept of "pengiraan pencen jpa bersara pilihan," exploring its importance and providing insights to help you make informed decisions regarding your retirement planning.

Imagine a life after years of dedicated service, where financial worries take a backseat, and you have the freedom to pursue passions and spend quality time with loved ones. This is the promise of a well-planned retirement. For Malaysian civil servants, the "pencen" or pension system plays a vital role in turning this dream into reality.

Navigating the complexities of the pension system can seem daunting, especially with terms like "pengiraan pencen jpa bersara pilihan" coming into play. However, understanding these concepts is empowering. It allows you to take control of your financial future and ensures a smoother transition into retirement.

"Pengiraan pencen jpa bersara pilihan," which translates to "calculation of JPA optional retirement pension," essentially refers to the process of determining the pension benefits an individual is eligible to receive upon retirement from the Malaysian civil service. The "pilihan" or optional aspect signifies that civil servants have choices to make regarding their retirement plans, which will ultimately influence their pension amount.

This article aims to demystify the concept of "pengiraan pencen jpa bersara pilihan." We will delve into its history, explore the factors influencing pension calculations, and discuss the implications of different retirement options available to civil servants. By empowering you with knowledge, we aim to help you make informed decisions that align with your financial goals and aspirations for a fulfilling retirement.

Advantages and Disadvantages of Early Retirement

While this article focuses on "pengiraan pencen jpa bersara pilihan" in general, it's important to consider the specific choice of early retirement. Here's a breakdown of its pros and cons:

| Advantages | Disadvantages |

|---|---|

| More time for personal pursuits and leisure | Potentially lower pension payout due to fewer years of service |

| Improved health and well-being by exiting a potentially stressful work environment | Possible difficulty adjusting to a non-working lifestyle |

| Opportunity to start a second career or business venture | The need to carefully manage finances for a potentially longer retirement period |

Remember, "pengiraan pencen jpa bersara pilihan" is a personalized process. Consulting with a financial advisor specializing in the Malaysian pension system can provide tailored guidance based on your individual circumstances. By carefully considering your options and making informed decisions, you can pave the way for a financially secure and rewarding retirement.

Portal Rasmi Jabatan Perkhidmatan Awam (JPA) | Innovate Stamford Now

Persaraan Pilihan : Syarat, Faedah & Cara Permohonan Bersara Pilihan | Innovate Stamford Now

Contoh Surat Permohonan Persaraan Awal Music Distribution | Innovate Stamford Now

pengiraan pencen jpa bersara pilihan | Innovate Stamford Now

42 Soal Jawab Lengkap Mengenai Pencen & Kalkulator Terbaru Pengiraan | Innovate Stamford Now

Contoh Surat Bersara Pilihan Guru | Innovate Stamford Now

pengiraan pencen jpa bersara pilihan | Innovate Stamford Now

Cara Mengisi Borang Pencen Dan Persaraan | Innovate Stamford Now

Contoh Surat Mohon Bersara Pilihan Contoh Surat Permohonan | Innovate Stamford Now

Contoh Surat Bersara Awal Kerajaan Surat Bersara Pilihan Pdf For | Innovate Stamford Now

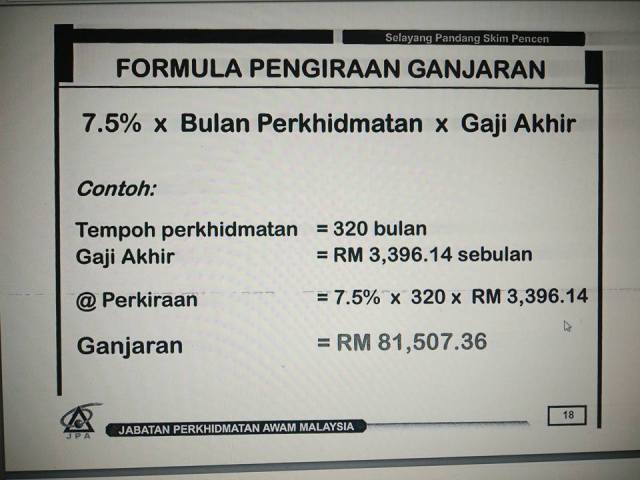

Formula Pengiraan Pencen Oleh JPA | Innovate Stamford Now

Cara Pengiraan Ganjaran Pencen Cara nak kira peratus | Innovate Stamford Now

Hadiah Persaraan Kakitangan Awam: Formula Pengiraan Pencen Oleh JPA | Innovate Stamford Now

pengiraan pencen jpa bersara pilihan | Innovate Stamford Now

Hadiah Persaraan Kakitangan Awam: Formula Pengiraan Pencen Oleh JPA | Innovate Stamford Now