Skip the Line: Your Guide to Wells Fargo Endorse Check for Mobile Deposit

Gone are the days of rushing to the bank before closing time, desperately hoping to deposit a check before the weekend hits. Thanks to the wonders of modern technology, depositing a check is now as simple as snapping a photo – all from the comfort of your couch. Wells Fargo, among other leading financial institutions, offers mobile check deposit, a game-changer for busy individuals and anyone who values convenience. But with this new technology comes a new set of rules, specifically how to endorse your check properly for a smooth and successful mobile deposit.

Let's face it, understanding the intricacies of financial jargon like "endorse" and "mobile deposit" can feel like deciphering a foreign language. This guide is here to demystify the process, breaking down everything you need to know about Wells Fargo's mobile check deposit feature, focusing particularly on how to endorse your checks correctly.

Endorsing a check for mobile deposit at Wells Fargo is slightly different than the traditional method. It requires a specific endorsement, including the phrase "For mobile deposit only at Wells Fargo." This added layer of security ensures that your check can only be deposited through the Wells Fargo mobile app, protecting you from potential fraud.

This guide will equip you with all the knowledge you need to navigate the world of mobile check deposits confidently. From understanding the basics to mastering the specifics of Wells Fargo's requirements, we'll cover it all. So, get ready to say goodbye to long bank lines and hello to the future of banking, one snapshot at a time.

Imagine this: you've just completed a freelance project, and the client has sent you a physical check. Instead of rearranging your schedule to make a bank run, you simply grab your phone, snap a photo of the check (with the correct endorsement, of course), and voila – funds on their way to your account. That's the power and convenience of Wells Fargo's mobile check deposit.

Advantages and Disadvantages of Wells Fargo Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience: Deposit checks anytime, anywhere. | Potential for technical issues with the app or your phone's camera. |

| Time-saving: No need to physically visit a bank branch. | May not be suitable for depositing large sums of money due to deposit limits. |

| Faster access to funds: Deposits are often processed quicker than traditional methods. | Requires a smartphone and internet access. |

Best Practices for Wells Fargo Mobile Check Deposit

- Ensure Good Lighting and Background: A clear image of your check is crucial. Use good lighting and a dark, non-reflective background for optimal results.

- Double-Check Endorsement: Verify that you've endorsed the check correctly, including the "For mobile deposit only at Wells Fargo" statement and your signature.

- Keep the Check for a Period: While not required to mail the physical check after a successful mobile deposit, it's advisable to keep it for a certain period (typically a few weeks) in case of any discrepancies or processing issues. This serves as proof of deposit. After the designated period, shred the check for security.

- Understand Deposit Limits: Familiarize yourself with Wells Fargo's mobile deposit limits, which may vary depending on your account type and history. If you need to deposit an amount exceeding the limit, you may need to visit a branch or explore other options.

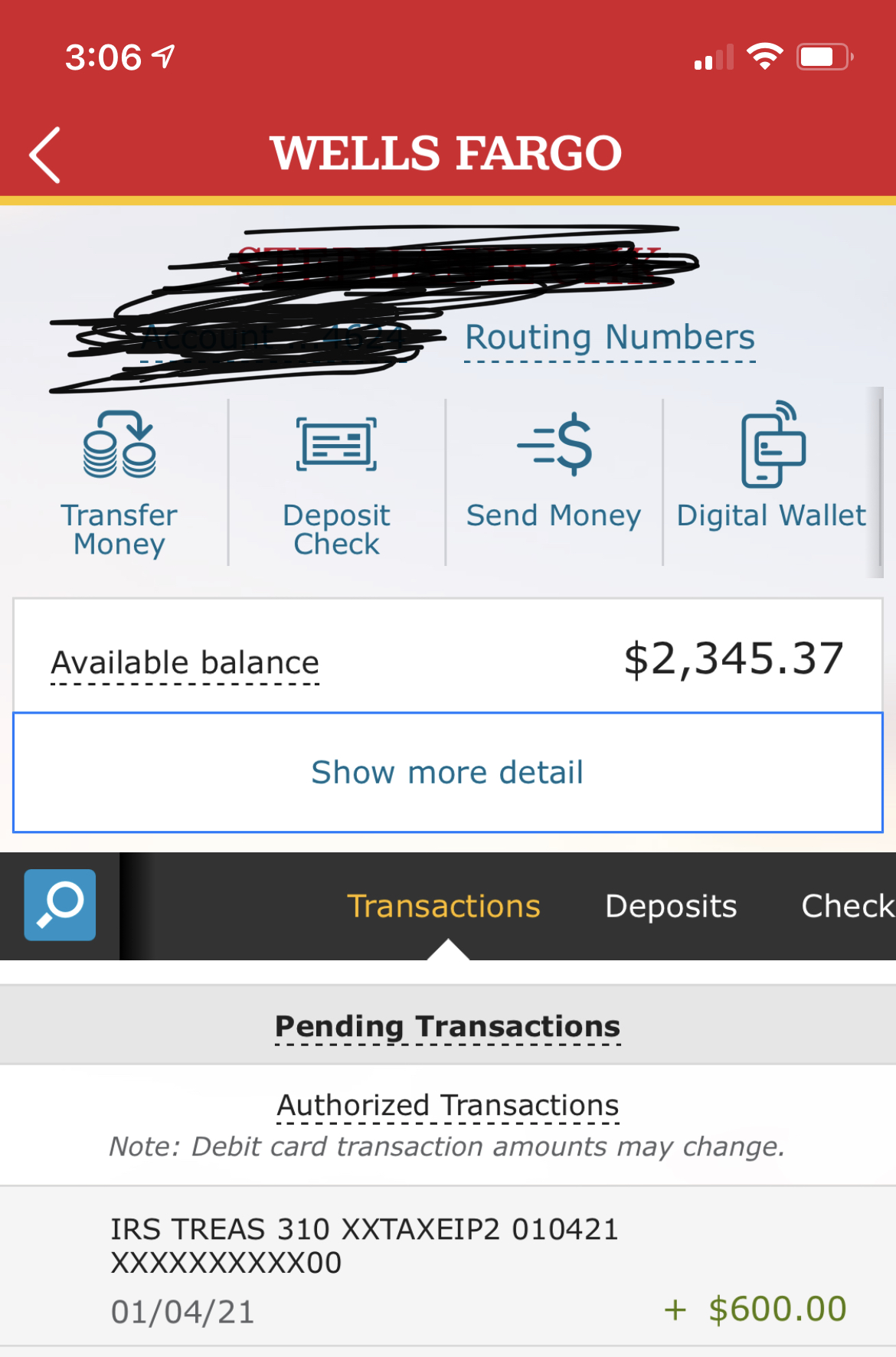

- Monitor Your Account: After depositing a check, regularly check your account balance through the app or online banking to ensure the funds have been credited successfully.

Common Questions and Answers

Q: What happens if I forget to write "For mobile deposit only at Wells Fargo" on my check?

A: The mobile deposit might be rejected. It's crucial to use the correct endorsement to ensure your deposit is processed smoothly. If you've made a mistake, you'll need to void the incorrect endorsement and endorse it again correctly before attempting another deposit.

Q: Is there a limit on how much I can deposit via mobile check deposit?

A: Yes, Wells Fargo sets limits on mobile check deposits, which may vary depending on your account type and history. You can usually find these limits within the mobile app or on the Wells Fargo website.

Q: What if I don't have a smartphone? Can I still use Wells Fargo mobile check deposit?

A: Unfortunately, mobile check deposit requires the use of a smartphone and the Wells Fargo mobile app. If you don't have access to a smartphone, you'll need to deposit your check using traditional methods, such as visiting a branch or ATM.

Mastering the art of the Wells Fargo mobile check deposit is like unlocking a new level of banking convenience. While it might seem like a small change, the ability to deposit checks anytime, anywhere can significantly impact your financial management. You no longer need to be tied down by branch hours or worry about finding an ATM. The power to manage your finances is literally at your fingertips. So, embrace the future of banking, download the app (if you haven't already), and experience the ease of Wells Fargo mobile check deposit for yourself.

Models ufc fight appearance sparks discussion

Unlocking daily laughs the far side cartoons free phenomenon

The secret world of fantasy character last names

How to Endorse a Check for Mobile Deposit | Innovate Stamford Now

wells fargo endorse check for mobile deposit | Innovate Stamford Now

Wells Fargo Check Deposit | Innovate Stamford Now

Wells Fargo Mobile Deposit | Innovate Stamford Now

Wells Fargo Mobile Deposit at Carol Young blog | Innovate Stamford Now

Everything You Need to Know About Cashing a Third Party Check | Innovate Stamford Now

wells fargo endorse check for mobile deposit | Innovate Stamford Now

How to Deposit Check Online Wells Fargo | Innovate Stamford Now

wells fargo endorse check for mobile deposit | Innovate Stamford Now

Wells Fargo Stimulus Check | Innovate Stamford Now

Printable Back Of Check Template | Innovate Stamford Now

How to Endorse a Check for Mobile Deposit | Innovate Stamford Now

How to Endorse a Check for Mobile Deposit | Innovate Stamford Now

How To Deposit A Check In A Wells Fargo ATM | Innovate Stamford Now

wells fargo endorse check for mobile deposit | Innovate Stamford Now