Smooth Sailing: Your Guide to Navy Federal Credit Union Boat Loans

Dreaming of owning a boat? Imagine yourself cruising across the open water, the wind in your hair, and the sun on your face. For many, this dream can become a reality with the help of financing, and Navy Federal Credit Union (NFCU) is a popular choice for those seeking boat loans. This article will explore the ins and outs of NFCU boat loan rates and provide you with the necessary information to make informed decisions.

Securing a boat loan can feel like navigating uncharted waters, but with a little guidance, you can find the right course. Navy Federal, known for serving military members and their families, offers competitive boat financing options. Understanding their loan rates, terms, and requirements is key to obtaining the best possible financing for your dream vessel.

NFCU boat loan interest rates are influenced by various factors, including credit score, loan term, and the age and type of boat. A higher credit score can often lead to a more favorable interest rate, while longer loan terms might result in higher overall interest paid. It's essential to carefully evaluate these factors and choose a loan structure that aligns with your financial situation.

While NFCU doesn't publicly list specific boat loan rates, potential borrowers can obtain personalized rate quotes by contacting the credit union directly or applying online. This allows for a tailored approach based on individual circumstances. It's advisable to compare rates from multiple lenders to ensure you're securing the most competitive offer.

Beyond interest rates, understanding the loan terms is crucial. NFCU offers various loan terms, which affect the monthly payment amount and the total interest paid over the life of the loan. Shorter terms typically result in higher monthly payments but lower overall interest, while longer terms mean lower monthly payments but potentially higher total interest.

The history of Navy Federal Credit Union dates back to 1933, founded with the mission of serving the financial needs of military members and their families. Since then, it has grown to become one of the largest credit unions in the United States, offering a wide range of financial products, including boat loans. These loans are designed to help members achieve their boating aspirations while providing competitive financing options.

One significant aspect of NFCU boat loans is their focus on member service. NFCU is known for its personalized approach and commitment to assisting its members throughout the loan process. This can be particularly helpful for those new to boat financing.

Benefits of obtaining a boat loan from NFCU can include competitive interest rates, flexible loan terms, and potentially lower fees compared to other lenders. They also often offer discounts for automatic payments and loyalty programs for existing members. For example, a member with excellent credit might qualify for a lower rate, potentially saving thousands of dollars over the loan term. Additionally, the flexibility in loan terms can allow borrowers to tailor their monthly payments to fit their budget.

Before applying for a boat loan with NFCU, gather necessary documentation, such as proof of income, identification, and information about the boat you intend to purchase. Comparing loan offers from multiple lenders is recommended to ensure you secure the best terms. After approval, maintain timely payments to build a positive credit history.

Advantages and Disadvantages of NFCU Boat Loans

| Advantages | Disadvantages |

|---|---|

| Competitive interest rates | Membership required |

| Flexible loan terms | May not offer the lowest rates for all borrowers |

| Excellent member service | Limited branch availability |

Frequently Asked Questions (FAQs):

1. What are typical NFCU boat loan rates? Contact NFCU directly for personalized rate quotes.

2. What is the maximum loan term for an NFCU boat loan? Contact NFCU for loan term information.

3. What types of boats are eligible for financing? Contact NFCU for eligible boat types.

4. How do I apply for an NFCU boat loan? Apply online or at a branch.

5. What credit score is needed for an NFCU boat loan? Contact NFCU for credit score requirements.

6. What documentation is needed for a boat loan application? Proof of income, identification, and boat information.

7. Can I get pre-approved for a boat loan? Contact NFCU for pre-approval information.

8. What are the closing costs associated with an NFCU boat loan? Contact NFCU for closing cost details.

Tips and tricks for navigating NFCU boat loans include: maintaining a good credit score, researching different boat types, and understanding the loan terms before signing. Comparing loan offers from other financial institutions is also essential to ensure you're getting the most favorable terms.

In conclusion, Navy Federal Credit Union offers boat loans that can help members realize their dreams of owning a boat. By understanding the factors influencing interest rates, loan terms, and the application process, you can navigate the world of boat financing with confidence. Taking the time to compare offers, gather necessary documentation, and manage your finances responsibly will set you on a course toward smooth sailing and enjoyable boating experiences. Contact NFCU today to explore your options and embark on your boating adventure. Remember that making informed financial decisions is key to responsible boat ownership and enjoying the pleasures of the open water for years to come.

The emblem of batu gajah community college symbolism and significance

Nfl week 8 predictions picking games with confidence

Unleash your inner monster the mike wazowski ball costume phenomenon

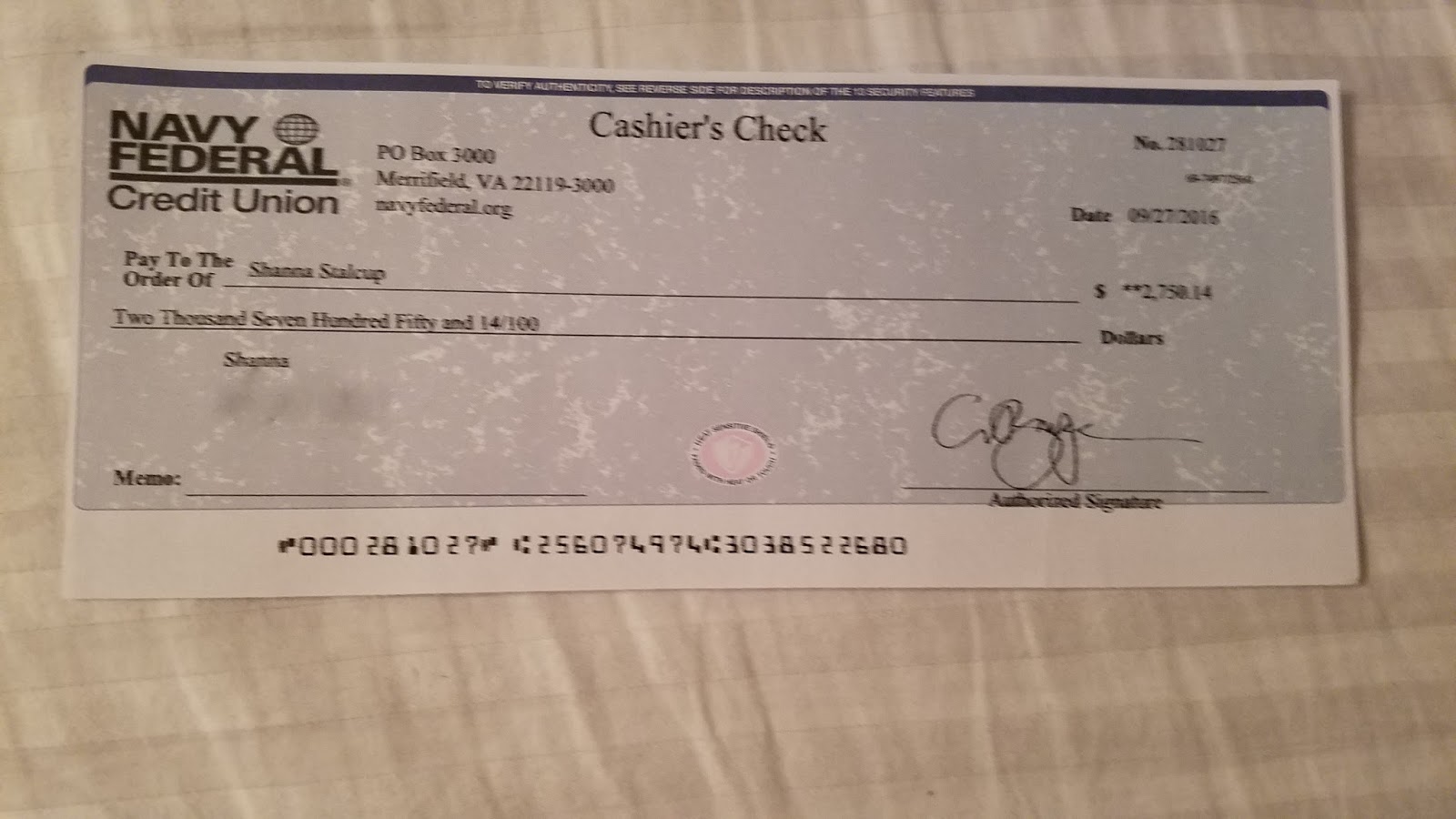

Real Navy Federal Credit Union Cashier S Check Image | Innovate Stamford Now

navy federal credit union boat loan rates | Innovate Stamford Now

navy federal credit union boat loan rates | Innovate Stamford Now

Debt Consolidation Navy Federal at Linda Aiken blog | Innovate Stamford Now

Why Are Boat Loan Rates High Now | Innovate Stamford Now

2024 Best New and Used Boat Loans | Innovate Stamford Now

Wire Transfer Navy Federal Credit Union Limit | Innovate Stamford Now

Navy Federal Credit Union | Innovate Stamford Now

Current Boat Loan Rates | Innovate Stamford Now

Find The Best Boat Loan Rates | Innovate Stamford Now

How to save when you refinance an auto loan from Navy Federal Credit | Innovate Stamford Now

Wire Transfer Navy Federal Credit Union Limit | Innovate Stamford Now

Routing Number For Marine Federal Credit Union Central Valley | Innovate Stamford Now

3 Months Navy Federal Credit Union Business Statements | Innovate Stamford Now

Navy Federal Cd Rates June 2024 | Innovate Stamford Now