Unlocking Homeownership: Your Guide to "Kelayakan Beli Rumah Mengikut Gaji"

Ever looked at shiny new condo towers or charming suburban homes and felt that pang of longing? That yearning for a place to call your own, a patch of earth (or sky, depending on the condo) to plant your metaphorical flag and declare, "This is mine!" It's a common desire, and for many people, "kelayakan beli rumah mengikut gaji," the idea of determining home affordability based on your income, is the key to unlocking that dream.

Let's be honest, buying a house isn't like picking out a new pair of shoes. It's a big, often intimidating, financial leap. It's easy to get lost in a whirlwind of mortgage rates, property taxes, and down payments, wondering if you'll ever be "financially fit" enough to even apply. That's where understanding "kelayakan beli rumah mengikut gaji" comes in. It's like having a financial roadmap, guiding you towards homeownership based on your current income and expenses.

Think of it as a reality check, a way to align your homeownership dreams with your financial reality. It's about understanding how much home you can comfortably afford based on your salary without stretching your finances thin. Because the last thing you want is to be "house poor," sacrificing avocado toast and vacations just to keep up with mortgage payments.

In many cultures, homeownership is seen as a rite of passage, a symbol of stability, and a legacy to pass down through generations. It's a tangible asset, a place to build memories, and a potential investment for the future. But achieving this dream requires careful planning and an understanding of your financial capacity.

That's why "kelayakan beli rumah mengikut gaji" is such a crucial concept. It empowers potential homebuyers to make informed decisions, ensuring that their home purchase is a joyful milestone, not a source of financial stress. So, let's dive in and explore how to navigate the path to homeownership, one paycheck at a time!

While "kelayakan beli rumah mengikut gaji" might seem like a mouthful, the concept is pretty straightforward. It's all about assessing your financial health, particularly your income, to determine how much you can realistically afford to borrow and repay for a home loan. Think of it as a financial litmus test for homeownership.

Advantages and Disadvantages of "Kelayakan Beli Rumah Mengikut Gaji"

| Advantages | Disadvantages |

|---|---|

| Provides a realistic budget for homebuying | Can limit your options in competitive markets |

| Helps you avoid taking on unmanageable debt | Doesn't account for potential future income increases |

| Provides peace of mind and financial security | May not consider other assets or financial resources |

Let's say your dream home is a charming three-bedroom bungalow with a white picket fence. "Kelayakan beli rumah mengikut gaji" helps you determine if that dream aligns with your current income or if you need to adjust your expectations and perhaps aim for a cozy two-bedroom apartment first. It's about making smart, informed choices to set yourself up for financial success in the long run.

Understanding "kelayakan beli rumah mengikut gaji" is like having a secret weapon in your homebuying arsenal. It empowers you to negotiate from a position of strength, knowing your financial boundaries, and ensures you're not stretching your budget thin. It's about making responsible decisions that lead to long-term financial stability and the joy of owning a place to call your own. So, take a deep dive into your finances, crunch those numbers, and embark on your homeownership journey with confidence and a clear vision. Your dream home awaits!

Navigating the houston financial landscape your guide to pncs presence

Mastering the art of rv trailer backing a comprehensive guide

Decoding medical imaging in jersey city your guide to nj imaging centers

Tips Beli Rumah Dan Cara Kiraan Mengikut Gaji | Innovate Stamford Now

Maksud Kategori Miskin Tegar, B40, M40 & T20 | Innovate Stamford Now

Semak Kelayakan Beli Rumah Mengikut Jumlah Gaji Secara Online | Innovate Stamford Now

Panduan Membeli Rumah Mengikut Kadar Gaji | Innovate Stamford Now

kelayakan beli rumah mengikut gaji | Innovate Stamford Now

Kelayakan Pinjaman Perumahan: Cara Kira & Semak Gaji Beli Rumah | Innovate Stamford Now

Kelayakan Loan Rumah Mengikut Gaji | Innovate Stamford Now

Beli Rumah Idaman pada Tahun 2024 | Innovate Stamford Now

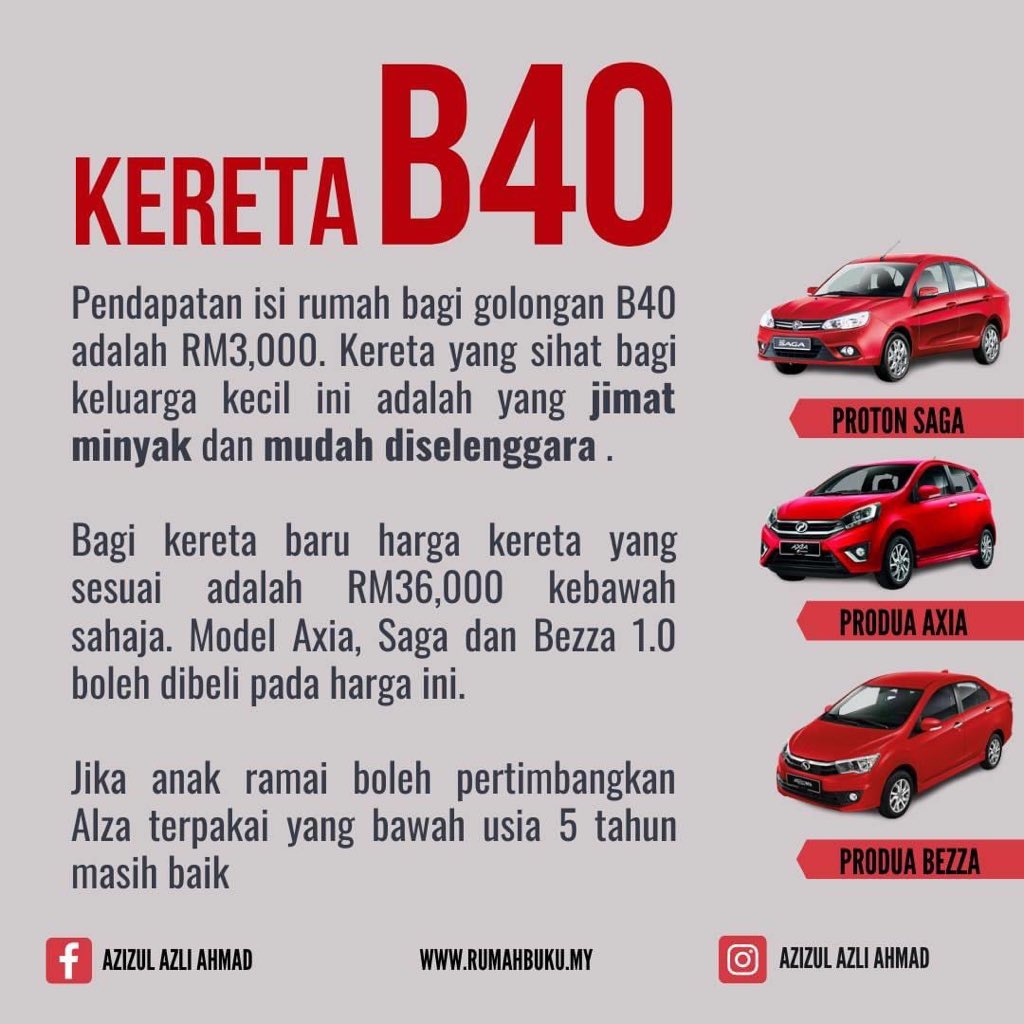

PANDUAN ASAS BELI KERETA IKUT GAJI B40, M40, T20 + HARGA | Innovate Stamford Now

Cara Kira Kelayakan Beli Rumah (Formula DSR) | Innovate Stamford Now

Jangan Beli Rumah Lebih 35% Dari Pendapatan, Ini Harga Rumah Yang | Innovate Stamford Now

Cara Kira Kelayakan Beli Rumah (Formula DSR) | Innovate Stamford Now

kelayakan beli rumah mengikut gaji | Innovate Stamford Now

Cara Kira Kelayakan Loan Rumah 2022 | Innovate Stamford Now