Unlocking the Secrets of Your Checks: A Guide to Finding Your Bank Account Number

Ever stared at a check, feeling a bit like an archaeologist on a dig, trying to decipher its cryptic markings? You're not alone. Knowing how to locate your bank account number on a check is a fundamental financial skill, and yet, it can sometimes feel surprisingly elusive. This guide will illuminate the mysteries of check anatomy and empower you to confidently find your bank account number every time.

Checks, those seemingly antiquated slips of paper, remain a surprisingly prevalent payment method. Understanding their layout is key to managing your finances effectively. Locating your bank account number is crucial for everything from setting up direct deposits to making online payments. So, let's dive in and decode these financial hieroglyphs.

Your bank account number is like a secret code that identifies your specific account. It's essential for any transaction involving your funds. Think of it as the address of your money. When you provide your bank account number, you're essentially telling the recipient where to find and access your funds. Therefore, understanding where this crucial piece of information resides on a check is paramount.

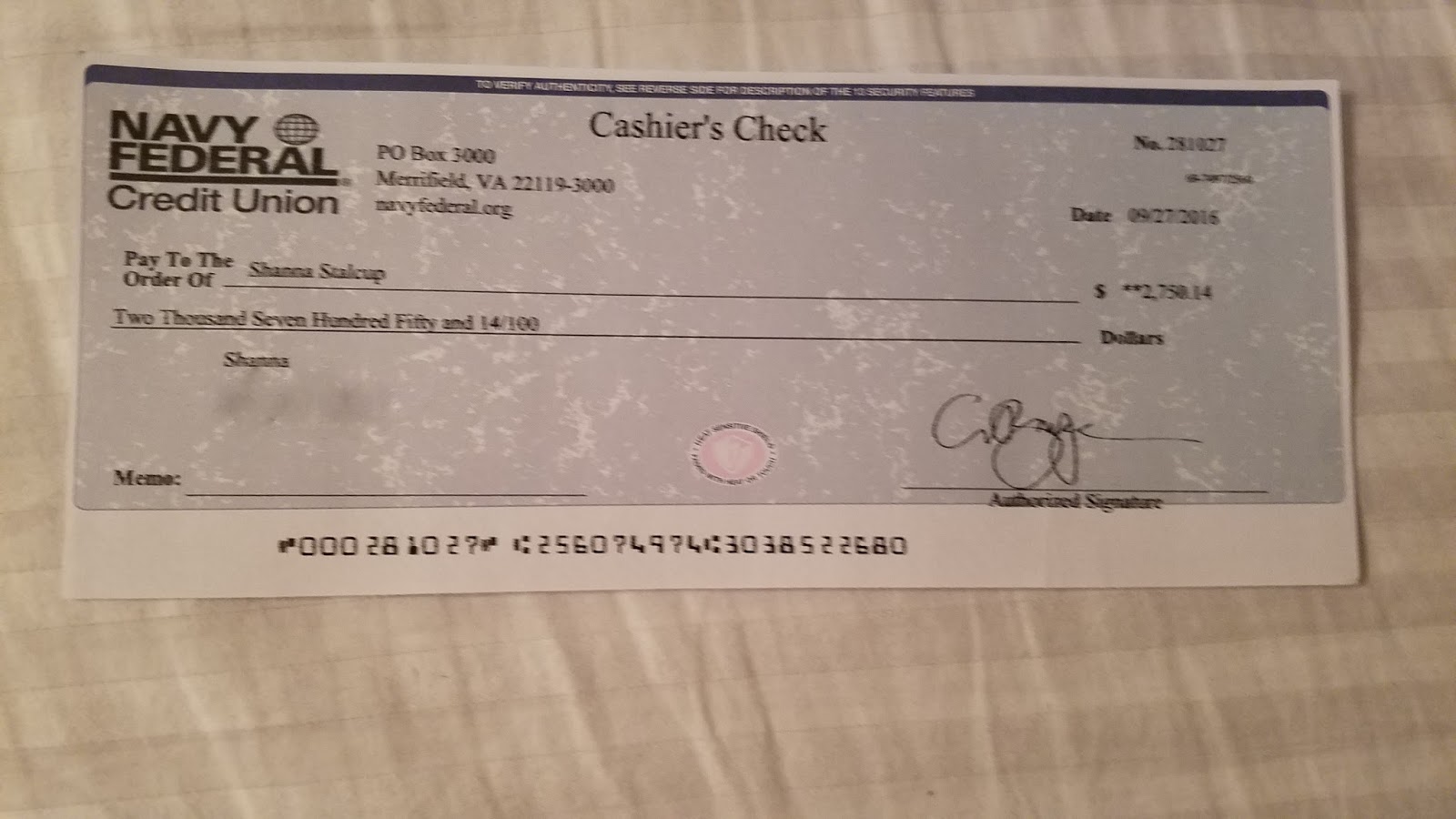

The placement of your bank account number is standardized, making it relatively easy to locate once you know where to look. Generally, you'll find it printed at the bottom of the check, alongside other important numbers. This includes the check number and the routing number. Understanding the relationship between these three numbers is crucial for navigating the world of checks.

Historically, checks have played a vital role in commerce, evolving from ancient forms of promissory notes. Today, despite the rise of digital payment methods, checks remain a relevant financial tool. The ability to locate your bank account number quickly and accurately is essential for smooth financial transactions. Misidentifying your account number can lead to delays, returned checks, and potential fees. So, let's demystify the process.

Your bank account number is typically a 9-12 digit number located at the bottom of the check, printed after the routing number. It is usually the second set of numbers printed along the bottom, appearing between the routing number and the check number. Look for a series of numbers printed in a special magnetic ink, often referred to as MICR (Magnetic Ink Character Recognition) ink. This ink allows machines to easily read and process the check information.

Benefits of knowing where to find your bank account number:

1. Setting up direct deposit: You need your bank account number to authorize your employer to deposit your paycheck directly into your account.

2. Making online payments: Many online bill pay services require your bank account and routing numbers to process payments.

3. Receiving electronic payments: If someone wants to send you money electronically, they'll often need your bank account number.

Step-by-step guide to locating your bank account number:

1. Look at the bottom of your check.

2. Find the three sets of numbers printed in magnetic ink.

3. Your bank account number is the second set of numbers, located between the routing number (on the left) and the check number (on the right).

Tips and tricks: If you're having trouble locating your account number, contact your bank. They can provide you with a copy of a check or confirm your account number over the phone.

Advantages and Disadvantages of Knowing Where to Find Your Bank Account Number

| Advantages | Disadvantages |

|---|---|

| Empowers you to manage finances independently. | Requires careful handling of checks to prevent fraud. |

Best Practices:

1. Store your checks securely to prevent unauthorized access.

2. Shred old or voided checks to protect your account information.

3. Be cautious about sharing your bank account number online or over the phone.

4. Regularly review your bank statements to monitor for any unauthorized transactions.

5. Consider using online banking for a more secure and convenient way to manage your finances.

FAQs:

1. What if my bank account number is missing from my check? Contact your bank immediately.

2. Can I find my bank account number online? Yes, most banks allow you to view your account number through online banking.

3. Is my bank account number the same as my routing number? No, they are different numbers serving different purposes.

4. What do I do if I suspect someone has accessed my bank account number fraudulently? Contact your bank immediately and report the suspected fraud.

5. Is it safe to write my bank account number on a check? Yes, it's printed on the check itself. However, handle checks carefully.

6. What if my check is damaged and I can't read the bank account number? Request a new check from your bank.

7. How can I protect myself from check fraud? Store your checks securely, shred old checks, and monitor your bank statements regularly.

8. Where can I find my bank account number if I don't have checks? Log into your online banking account or contact your bank directly.

In conclusion, knowing where to find your bank account number on a check is a fundamental aspect of managing your personal finances. It empowers you to conduct a variety of financial transactions, from setting up direct deposits to making online payments. While checks may seem like relics of the past, they remain a relevant payment method, and understanding their anatomy is crucial for navigating the modern financial landscape. By following the simple steps outlined in this guide, you can easily locate your bank account number and take control of your financial well-being. Remember to always handle your checks securely and be mindful of protecting your sensitive financial information. Taking proactive steps to safeguard your financial data will contribute to a more secure and confident financial future. Don't hesitate to reach out to your bank if you have any questions or concerns about your account information. They are there to assist you in navigating the sometimes complex world of personal finance.

Rad comp of maryland

Navigating shady business synonyms for monkey business explained

Elevate your island escape cultivating festive cheer with animal crossing christmas inspiration

Co to jest Numer Routingowy na czeku i jak działa | Innovate Stamford Now

Wire Transfer Navy Federal Credit Union Limit | Innovate Stamford Now

Pnc Bank Wiring Information | Innovate Stamford Now

Checking Account Check Registers 1 Answers at Linda Greenfield blog | Innovate Stamford Now

Where do I find my routing number | Innovate Stamford Now

How to Find Citibank Routing Number In September 2024 | Innovate Stamford Now

Show Me Usa Number at Tracy Washington blog | Innovate Stamford Now

How To Wire Transfer Navy Federal | Innovate Stamford Now

Define Transit Number at Elaine Pace blog | Innovate Stamford Now

Signature Bank Routing Number For Wires at Vanessa Messina blog | Innovate Stamford Now

Print Checks On Blank Check Papers | Innovate Stamford Now