Unlocking Your Future: A Look at the Pengeluaran KWSP Pemberian Taraf Berpencen Scheme

Imagine a safety net, woven with threads of financial security, ensuring a dignified life even after years of dedicated service. For many Malaysians, this vision is tied to the Employees Provident Fund (EPF), a social security institution that plays a pivotal role in retirement planning. Within the framework of the EPF lies a particular scheme, often discussed but not always fully understood: the "Pengeluaran KWSP Pemberian Taraf Berpencen" - a mouthful, yes, but one that holds significant weight for a specific segment of the Malaysian workforce. This scheme, designed to provide pension-like benefits to eligible individuals, has become a topic of increasing interest, prompting discussions about its impact, potential benefits, and the challenges it presents.

This exploration aims to demystify the "Pengeluaran KWSP Pemberian Taraf Berpencen" scheme. We'll delve into its historical context, unravel its complexities, and examine its potential impact on the financial well-being of those it aims to serve. Whether you're nearing retirement, planning for your future, or simply curious about Malaysia's social security landscape, understanding this scheme is crucial for navigating the path towards a secure and comfortable retirement.

At its core, "Pengeluaran KWSP Pemberian Taraf Berpencen" refers to a specific withdrawal scheme within the broader EPF system. It's targeted towards individuals who have retired from public service and are eligible to receive pensions. This scheme allows them to access a portion of their EPF savings in a way that complements their existing pension benefits, providing an additional layer of financial security.

The scheme's existence stems from a recognition of the evolving needs of retirees and the desire to ensure their financial well-being. As life expectancy increases and the cost of living continues to rise, relying solely on pensions might not be sufficient for some individuals. The "Pengeluaran KWSP Pemberian Taraf Berpencen" scheme addresses this concern by offering a flexible mechanism to supplement their income during retirement.

However, like any financial scheme, "Pengeluaran KWSP Pemberian Taraf Berpencen" is not without its complexities and potential drawbacks. Navigating its regulations and understanding its implications requires careful consideration and often, expert guidance.

While the concept of supplementing retirement income is undoubtedly beneficial, the specifics of the "Pengeluaran KWSP Pemberian Taraf Berpencen" scheme have sparked debate and raised important questions. These range from concerns about its long-term sustainability to potential inequalities in its application. As with any policy that impacts a significant portion of the population, a balanced and nuanced understanding is essential.

This exploration seeks to provide that understanding. We'll delve deeper into the mechanics of "Pengeluaran KWSP Pemberian Taraf Berpencen," examining its eligibility criteria, withdrawal options, and the potential benefits and drawbacks it presents.

Conquer your fuel gauge a boat owners guide to accurate readings

Finding solace in sunset navigating funeral obituaries in dothan al

Unlocking potential a deep dive into jinn shern industry co ltd

44+ Pengiraan Pengeluaran Kwsp Taraf Berpencen 2020 Gif | Innovate Stamford Now

.webp)

Cara Mengeluarkan KWSP Taraf Berpencen 2024 | Innovate Stamford Now

Borang Pengeluaran Kwsp Pencen | Innovate Stamford Now

pengeluaran kwsp pemberian taraf berpencen | Innovate Stamford Now

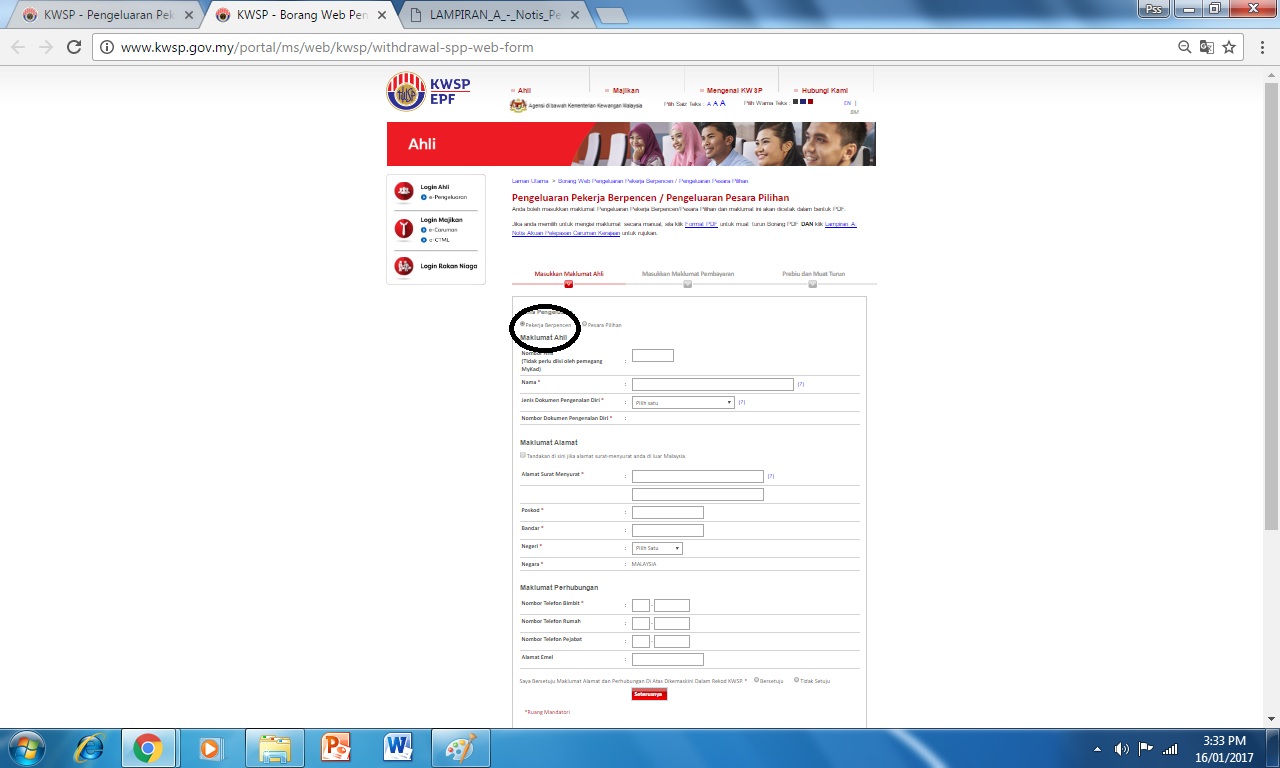

Borang Pengeluaran Kwsp Pemberian Taraf Berpencen | Innovate Stamford Now

Cara Mengeluarkan KWSP Taraf Berpencen 2023 | Innovate Stamford Now

Panduan Mengisi Borang Pengeluaran Kwsp Kwsp Borang Pendaftaran | Innovate Stamford Now

44+ Pengiraan Pengeluaran Kwsp Taraf Berpencen 2020 Gif | Innovate Stamford Now

Cara Pengeluaran KWSP Berpencen 2023 | Innovate Stamford Now

(DOC) SENARAI SEMAK PEMBERIAN TARAF BERPENCEN | Innovate Stamford Now

Cara Mengeluarkan KWSP Taraf Berpencen 2023 | Innovate Stamford Now