Unlocking Your True Take-Home Pay: A Guide to Understanding Net Income

Ever feel a twinge of disappointment when you see your paycheck and it's less than you expected? You're not alone. The difference between your gross pay (the number on your contract) and your net pay (what you actually take home) can be eye-opening, but it doesn't have to be a mystery. Understanding your net income – what's left after taxes are taken out – is crucial for effective budgeting and achieving your financial goals.

Calculating your net income is more than just a mathematical exercise; it's about understanding the value of your hard work and making informed decisions about your money. This knowledge empowers you to budget realistically, negotiate salary with confidence, and plan for a financially secure future.

The concept of income tax has been around for centuries, used by governments to fund public services and infrastructure. As tax systems evolved, so did the need for individuals to understand their personal tax obligations and the impact on their take-home pay. Today, accurately calculating net income is paramount, especially in a world with complex tax codes and varying deductions.

However, this seemingly simple task can present challenges. Tax systems can be complex, varying greatly between countries and even regions. Deductions for retirement contributions, healthcare, and other benefits can further complicate the calculation. Misunderstanding these factors can lead to budgeting errors and financial strain.

That's why it's essential to understand the key elements involved in calculating your net income. By understanding your tax bracket, allowances, deductions, and credits, you can ensure you're not overpaying or, worse, underpaying your taxes. This knowledge gives you the power to plan your finances effectively, maximize your savings, and achieve your financial aspirations with confidence.

Advantages and Disadvantages of Calculating Net Income

While the benefits of understanding your net income are numerous, it's worth acknowledging potential drawbacks:

| Advantages | Disadvantages |

|---|---|

| Accurate budgeting and financial planning | Complexity of tax codes and regulations |

| Informed decision-making regarding salary and benefits | Time commitment required to understand and calculate accurately |

| Increased awareness of tax obligations and potential savings | Potential for errors if calculations are not performed correctly |

Best Practices for Calculating and Managing Your Net Income

Here are some best practices to help you effectively manage your net income:

- Utilize Online Calculators and Resources: Leverage reputable online salary calculators and tax websites to simplify the process. These tools often provide up-to-date information on tax rates and deductions, saving you time and effort.

- Seek Professional Advice: For complex financial situations or if you're unsure about specific deductions or credits, consult with a qualified tax advisor or financial planner. Their expertise can provide personalized guidance and help you optimize your tax liability.

- Stay Informed About Tax Law Changes: Tax laws and regulations can change frequently. Stay informed about any updates or revisions that may affect your tax bracket, deductions, or overall net income. Subscribing to reputable financial newsletters or consulting official government websites can help you stay current.

- Review Paystubs Regularly: Regularly check your paystubs to ensure accurate tax withholdings and deductions. Familiarize yourself with the different components of your paystub and don't hesitate to contact your employer's HR or payroll department if you notice any discrepancies.

- Automate Savings: Make saving a habit by setting up automatic transfers from your checking account to your savings or investment accounts. By automating your savings, you ensure that a portion of your net income is consistently allocated towards your financial goals.

Frequently Asked Questions About Net Income

Here are some common questions people have about net income:

- Q: What is the difference between gross income and net income?

A: Gross income is your total earnings before any deductions, while net income is your take-home pay after taxes and other deductions are withheld. - Q: What are some common deductions that can affect my net income?

A: Common deductions include income tax, social security contributions, health insurance premiums, and retirement plan contributions. - Q: How can I reduce my tax liability and increase my net income?

A: Consider maximizing eligible deductions and credits, such as retirement contributions or charitable donations. Consulting with a tax advisor can help identify potential tax-saving strategies tailored to your circumstances. - Q: Does everyone pay the same amount of taxes?

A: No, tax systems often employ a progressive tax system, meaning higher earners typically pay a larger percentage of their income in taxes compared to lower earners. - Q: What happens if I overpay or underpay my taxes?

A: Overpaying can result in a refund, while underpaying may lead to penalties or interest charges. Ensure your tax withholdings are accurate to avoid unexpected surprises during tax season.

Tips for Maximizing Your Net Income

Here are a few additional tips to help you make the most of your earnings:

- Negotiate Your Salary: Don't be afraid to negotiate your salary when starting a new job or during performance reviews. Research industry standards and present a well-reasoned case to justify your worth.

- Explore Additional Income Streams: Consider diversifying your income by exploring side hustles, freelance work, or passive income opportunities. These additional income streams can significantly impact your overall financial well-being.

- Live Below Your Means: Embrace a frugal lifestyle and prioritize needs over wants. By spending less than you earn, you free up more of your net income for savings, investments, and achieving your financial goals.

Mastering the art of calculating and managing your net income is a fundamental aspect of achieving financial freedom. By understanding the factors that influence your take-home pay, you can make informed decisions about your money, optimize your earnings, and pave the way for a secure and prosperous future. Embrace the power of financial knowledge, take control of your income, and unlock your true earning potential.

Unlocking potential a deep dive into dong a hwa sung co ltd

Unlocking the quirks of unusual text copy pasting strange characters

Unveiling the mystery watchers in the night painting

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

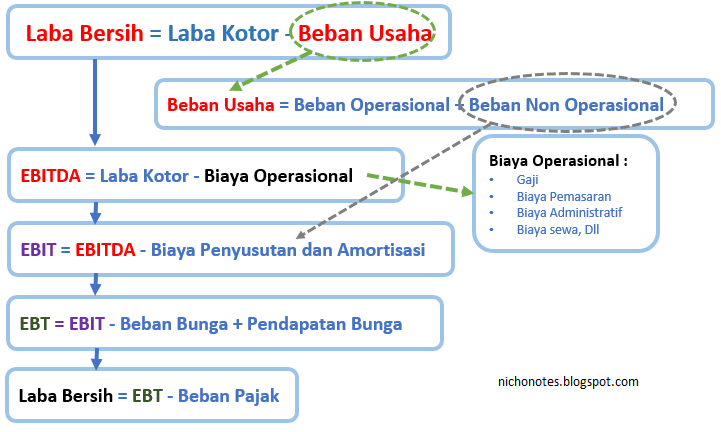

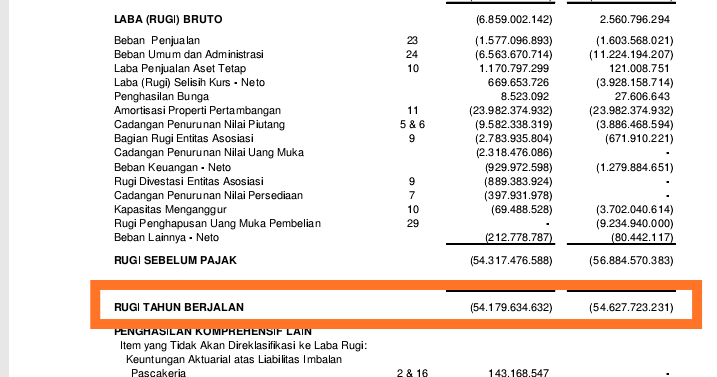

Laba Bersih Di Laporan Keuangan | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

Cara Hitung THR untuk Karyawan Outsourcing | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

Contoh Laporan Keuangan Lengkap dan Cara Membuatnya! | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

menghitung gaji setelah pajak | Innovate Stamford Now

6. Sintaks Pemilihan 2 · Dasar Pemrograman | Innovate Stamford Now